A US$100 oil price would likely boost ASX shares in the energy space and raise Australian petrol prices by about 15 cents per litre, according to experts.

As we reported last week, the International Monetary Fund (IMF) has revised its estimates of the oil price Saudi Arabia needs to balance its budget, given current restrictions on oil production.

The IMF now believes Saudi Arabia will need an average Brent crude oil price of US$96.20 per barrel this year if the government keeps its current production limit at 9.3 million barrels per day.

Last Friday, when Israel launched a strike on Iran, the Brent crude oil price spiked to US$90.66 per barrel and the WTI price went to about US$86 per barrel.

Both retreated quickly as it became clear the strike was narrow and possibly only intended to demonstrate that Israel has missiles capable of reaching Iranian territory.

Higher oil prices mean higher petrol prices

AMP chief economist Dr Shane Oliver said higher oil prices would mean higher petrol prices.

He noted that Australian petrol prices are already around record levels despite oil prices being well below their 2022 highs.

Using the WTI price as a guide, Oliver said an increase in the oil price from about $US85 per barrel to around $US100 per barrel would add about 15 cents per litre to average Australian petrol prices.

This would have flow-on effects on the economy, potentially dampening efforts to reduce inflation.

A US$100 WTI oil price would "push the weekly household petrol bill in Australia to a record $76 up $10 a week from where it was a year ago", Oliver said.

"This would mean more than $500 less a year for the average family available to spend on other things."

The risks relating to Iran

At this stage, Iran has indicated it will not respond to Israel's strike last week.

This is a relief to Western nations because Iran becoming involved in the war on an ongoing basis would only destabilise the Middle East further, and possibly disrupt oil supplies.

Oliver explains the repercussions of such an escalation:

This would threaten Iran's 3% of world oil production and the flow of oil through the Strait of Hormuz (through which roughly 20 million barrels a day or 20% of world oil production flows mainly enroute to Asia).

Another sharp spike in oil prices would be a threat to the economic outlook as it could boost inflation again and risk adding to inflation expectations potentially resulting in higher than otherwise interest rates and act as a tax hike on consumers leaving less to spend on other things.

Impact of higher oil prices on ASX oil shares

Oil producers and refiners typically earn more when oil prices go higher.

However, rising oil prices also mean higher input costs for many businesses, especially those in the transport sector, and this can negatively impact their net earnings.

As Oliver notes, higher oil prices also lead to higher petrol prices, eating into household budgets and reducing their general spending capacity, which impacts other businesses outside the energy space.

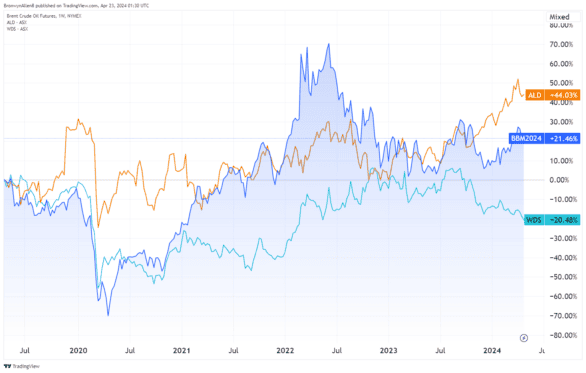

The chart below shows Brent Crude oil futures and the Ampol Ltd (ASX: ALD) and Woodside Energy Group Ltd (ASX: WDS) share prices over five years.

As you can see, there are some similar patterns between the Ampol share price and the oil price.

However, there are many other factors impacting the Ampol share price and company earnings, so it's not surprising that the two have not moved together in perfect unison.

Other oil shares like Woodside are only partly affected by oil price movements because oil is just one component of their business. The other big component is gas.

But it's fair to say that higher oil prices are a likely tailwind for the share prices of ASX oil shares.