This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

After having an incredible 2023, Nvidia (NASDAQ: NVDA) hasn't slowed a bit in 2024. It's up nearly 80% this year, placing among the top-performing stocks again in back-to-back years.

But because of such a tremendous start, most wonder if Nvidia has room for more upside. I think it does, but there's also a possibility it could reverse course.

Nvidia is a key part of the AI technological boom

Nvidia has been a rockstar of a stock because of its ties to artificial intelligence (AI). Its primary product, graphics processing units (GPUs), are an integral part of training AI models due to their ability to compute in parallel. When GPUs are tasked to train an AI model, companies don't just use one or two of them. Instead, they use thousands to increase the computing power.

Nvidia's flagship GPU for training AI models is the H100, and it costs around $40,000 apiece. When companies purchase these GPUs by the thousands at that price, it's a great sign for Nvidia's business.

This has shown up in Nvidia's financial results in a big way, like when its revenue increased by 265% year over year to $22.1 billion in the fourth quarter of fiscal year 2024 (ending Jan. 28). With the infrastructure needed to train all of these AI models not yet built, it's a great sign for Nvidia that the demand for its product will still be high.

This is the base thesis on why Nvidia's stock still has room for upside, as no one knows when there will be enough computing capacity to quench the demand for AI training. However, there's a flip side to this coin as well.

Once the industry has built out the computing power it needs to satisfy the demand, Nvidia's revenue stream will dry up. Its GPUs are one-time purchases unless a client upgrades, which could be an issue. Nvidia will still be around, as it has multiple other business segments. But, with so much of its revenue coming from this AI demand wave, Nvidia will eventually face a downturn.

It's unknown how long it will take to build all the computing power for AI demand or when it will start to plateau. This is the debate behind Nvidia's stock, but we'll get a better glimpse of how it's going in a month.

Nvidia's stock could move either way after its Q1 earnings

While Nvidia's stock is up almost 80% this year, it's only up 12% since its last earnings report. That's because most news that drives the stock will be released in that announcement.

If past trends hold, Nvidia's fiscal first-quarter results should be announced sometime in late May. If Nvidia's management gives positive forward-looking guidance and says it will maintain the status quo, don't be surprised if the stock gains even more. But if management discusses demand leveling out, be prepared for a severe sell-off.

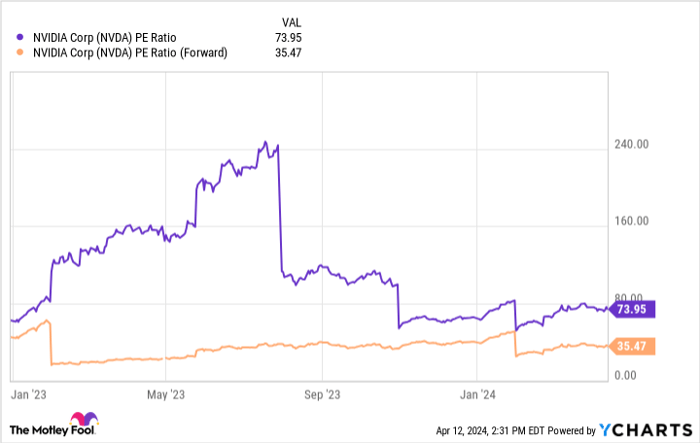

Nvidia has a lot of expectations built into the stock, and one of those is strong growth for all of this year. By looking at the difference between a stock's trailing price-to-earnings (P/E) ratio versus its forward P/E, you can calculate the expected earnings growth rate for the year.

NVDA PE Ratio data by YCharts

For Nvidia, that's 109%. So, Nvidia must at least double its earnings, or it will fall short of analyst expectations.

That's a high bar to clear, but considering Nvidia's earnings per share (EPS) grew by 765% in Q4, it's possible.

So, to answer the question, does Nvidia's stock have room for more? I'd say absolutely. If AI demand continues to drive Nvidia's revenue higher than expectations, it could still rise further. But, if it fails to meet those lofty goals, the stock has a long way to tumble.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.