Inflation is an insidious, wealth-devouring monster that can erode fortunes if left unchecked. Some will turn to gold to ward off this threat, but I'd opt for top-quality ASX shares.

Gold has long been seen as a store of value. The precious metal's scarcity and appealing physical traits make it a go-to among many for wealth preservation. Its gradually growing supply makes it a popular asset for those hedging against inflation.

Yet, if beating inflation is the goal, I'd argue investing in shares is a much better choice.

Going for 'better than' gold

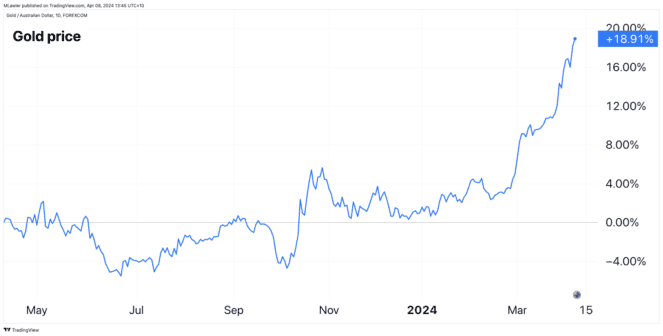

The price of gold — in Aussie dollars — is up 18.9% over the past year, as depicted below. Yes, that's 12.4% more than what the S&P/ASX 200 Index (ASX: XJO) has increased. However, a single year of performance is hardly definitive.

To maintain your money's purchasing power between 1 July 1993 and 30 June 2023, it would have needed to grow in value by 120%. Put simply, $10,000 in 1993 had to become $21,979 — otherwise, your wealth went backwards.

The gold bugs out there can breathe a sigh of relief AS gold has indeed outpaced inflation over the last 30 years. A $10,000 hoard of gold in 1993 is now worth about $29,150 based on today's price. But that's only a 'real return' of about 1% per annum above inflation.

Comparatively, Australian shares have generated a real return of 6.5% per annum above inflation. In dollar terms, that's the difference between having $29,150 (gold) or $138,778 (Australian shares) left at the end of investing for 30 years.

My top ASX shares to fight inflation

Simply buying the Aussie index with an exchange-traded fund (ETF) is where I'd start to give inflation the boot — either the BetaShares Australia 200 ETF (ASX: A200) or the Vanguard Australian Shares Index ETF (ASX: VAS) are my preferences for diversification.

From there, I'd sprinkle in quality businesses that I believe will perform even better than the index.

Right now, several Australian companies come to mind. The first two are ASX retail shares, Accent Group Ltd (ASX: AX1) and Super Retail Group Ltd (ASX: SUL).

Accent is known for its extensive footwear store presence, including Athletes Foot, Platypus, and Hype DC. Super Retail Group's familiar faces are Supercheap Auto, BCF, Rebel, and Macpac. Both companies have a long history of successfully executing their growth ambitions, and neither looks at all expensive at their price-to-earnings (P/E) ratios of 15 and 13.

My other top ASX shares to give inflation the flick are NIB Holdings Limited (ASX: NHF) and Deterra Royalties Ltd (ASX: DRR). In my opinion, both companies are insulated from inflation to a certain extent.

NIB, a private health insurer, can increase its premiums on what is a fairly sticky product. Meanwhile, Deterra, a collector of iron ore royalties, has minimal expenses that could rise from inflation.