When an S&P/ASX 200 Index (ASX: XJO) stock outperforms all and sundry one year but then suddenly dips, you need to at least check out what's happening.

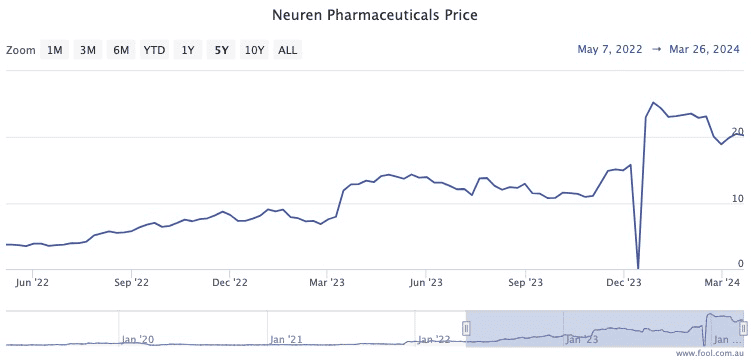

Neuren Pharmaceuticals Ltd (ASX: NEU) was the highest climber in the ASX 200 last year, gaining an insane 214% over the calendar year.

But a reality check has been delivered for investors this year, with an 18.6% tumble so far.

So what's doing? Is this a bargain just waiting to be bought?

Why has Neuren become a cheap ASX stock?

Neuren develops treatments for rare neurological conditions.

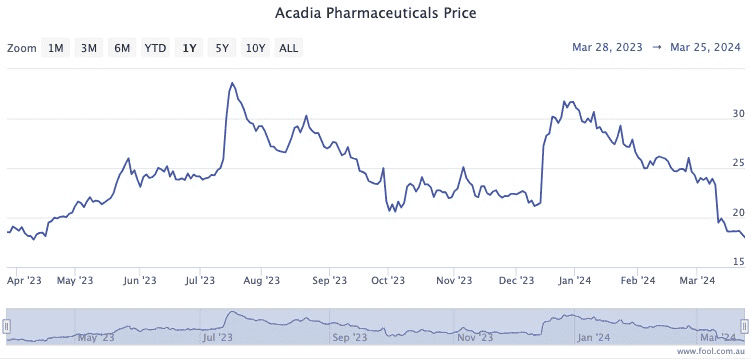

While it's developing and testing future products, it already has a drug called Daybue on sale through its US licensee Acadia Pharmaceuticals Inc (NASDAQ: ACAD).

The analysts at Blackwattle explained in a memo that the main reason why Neuren shares have plunged in 2024 lies in this relationship.

"The underperformance resulted from a 'short report' released on Neuren's US distributor, questioning the efficacy of NEU's therapy and the retention rate of patients."

The author of the report, Culper Research, claimed that Daybue has been "a total flop".

"The sell-side sell calls for over $800 million in peak Daybue revenues, but our research suggests that Daybue new patient starts already topped this past summer, peak revenues will be a mere fraction of sell-side estimates, and Daybue's flop will have knock-on effects as ACADIA remains a cash-burning machine."

Ouch.

Should you buy Neuren Pharmaceuticals?

So is this a value trap or a golden opportunity to buy into a fast-growing company for dirt cheap?

Multiple Australian investment houses disagree with the short report.

The Blackwattle memo admitted the damaging claims have "impacted sentiment towards the stock" in the near term, but the short report is "at odds with trial data and the real-life experience of medical specialists, patients, and their carers".

The team at the Elvest Fund is also keeping the faith.

"Our thesis for Neuren Pharmaceuticals is unchanged," it said in its memo to clients.

"New CY24 Daybue sales guidance of US$370 to US$420 million (+120%) underpins another solid year of royalty and milestone revenue for Neuren."

Broking platform CMC Invest shows unanimous agreement, with all six analysts surveyed there still rating the stock as a buy.

So it seems this "cheap" ASX stock could be a genuine bargain for those willing to hold on for the long run.