After opening in the red, the S&P/ASX 200 Index (ASX: XJO) finally struggled into the green by late morning today.

At 11:30am AEST on Wednesday, the benchmark Aussie index was up a fraction of a percent at 7,783.8 points.

That's when the Australian Bureau of Statistics (ABS) published the latest Australian inflation data, covering the month of February.

And the ASX 200 marched to 7,809.0 points in the minutes that followed, up 0.4%.

Here's what's happening on Australia's inflation front.

ASX 200 lifts on ABS inflation data

Forecasts were mixed on what to expect from today's inflation print, with consensus estimates coming in at a 3.5% annual rate.

But as we can see by the boosted sentiment on the ASX 200, those consensus expectations proved a little on the high side.

According to the latest data from the ABS, the monthly Consumer Price Index (CPI) indicator increased 3.4% in the 12 months to February.

That's close to the Reserve Bank of Australia's 2% to 3% target range. A range ASX 200 investors are keeping a close eye on amid hopes for interest rate cuts in 2024.

However, while inflation has come off the boil, it is proving sticky at these still elevated levels.

"Annual inflation was unchanged in February and has been 3.4% for three consecutive months," said Michelle Marquardt, ABS head of prices statistics.

The biggest factors driving ongoing price pressures in February were housing, up 4.6%; food and non-alcoholic beverages, up 3.6%; alcohol and tobacco, up 6.1%; and insurance and financial services, up 8.4%.

Renters are doing it particularly tough, with rents up by 7.6% for the year, an increase from 7.4% in January.

As for underlying inflation – which excludes things like petrol, holiday travel, and fruit and vegetables from CPI headline inflation – the 12-month increase to February was 3.9%, down from 4.1% in January.

"Annual inflation excluding volatile items has continued to slow over the last 14 months from a high of 7.2% in December 2022," Marquardt said.

And despite the hordes of big-spending Swifties, holiday travel and accommodation prices fell 1.3% in the 12 months to February.

"Although Taylor Swift performances saw hotel prices rise in Sydney and Melbourne, elsewhere accommodation and airfare prices fell in February due to the end of the peak travel during the January school holiday period." Marquardt said.

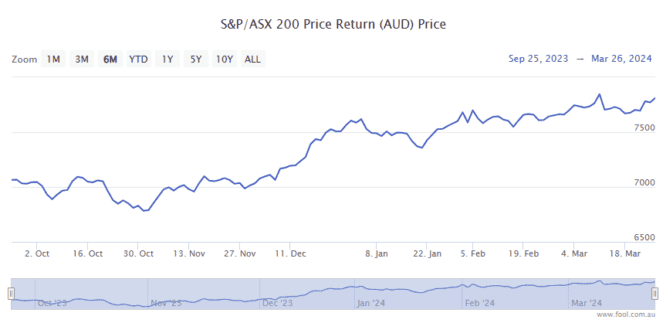

Having set several new all-time highs this year despite high interest rates and sticky inflation, the ASX 200 is up 11% over the past six months.