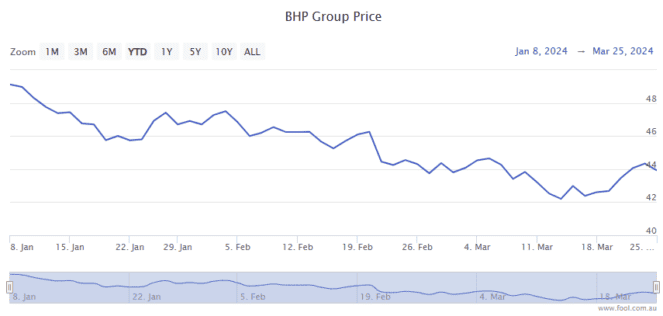

The BHP Group Ltd (ASX: BHP) share price kicked off the week with some strength, closing up 0.2% on Monday.

But shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner gave up those gains and then some yesterday, closing down 0.6% at $43.62 apiece.

In early afternoon trade today, the BHP share price is down 0.3% at $43.47.

That sees the ASX 200 mining stock down 13.8% since the closing bell rang on 2023. That compares to a 2.8% gain posted by the ASX 200 over this same period.

Here's why the miner has come under selling pressure again today.

Headwinds from the Middle Kingdom

BHP derives the bulk of its revenue from digging up and processing iron ore.

Copper comes in at number two.

If you have a look at how those two base metals are performing, it explains a lot of the pressure we're seeing on the BHP share price.

Iron ore futures dropped 4.2% overnight to US$104.05 per tonne. On Friday, the steel-making metal appeared to be in recovery mode, trading for US$109.15. Though that remained well below the US$144 that same tonne was trading for on 2 January.

Copper has retraced as well, down 2.5% since Monday. The red metal is currently trading for US$8,862 per tonne. However, in copper's case, that's up 3.8% in 2024 from US$8,545 per tonne on 2 January.

The headwinds hitting base metal prices and the BHP share price are once again blowing out of China.

Last week's iron ore rebound was driven by expectations of a pick up in growth from the world's number two economy and Australia's top export market.

This week, the market looks to be having its doubts as to the likelihood that China's struggling, steel hungry property sector has turned the corner.

Investors are still awaiting increased stimulus measures from the Chinese government. But it remains uncertain if those will materialise.

Commenting on the metals markets, Wei Ying, an analyst at China Industrial Futures, said (quoted by The Australian Financial Review), "Investors are very cautious about the demand outlook. Prices fall whenever there are signs of demand weakness."

She noted that Chinese steel trading volumes had slipped again.

Jiang Hang, head of trading at Yonggang Resources, added:

The rally in base metals prices has gone ahead of real demand. Chinese demand has been badly hit after prices rose, especially copper.

Now what?

While the future is inherently uncertain, the sell-off in the BHP share price so far in 2024 could offer an opportune entry point.

Commenting on the iron ore price outlook last week, Australia and New Zealand Banking Group Ltd (ASX: ANZ) analysts Daniel Hynes and Soni Kumari said:

Iron ore prices may be near a floor amid a reset in expectations around [China's] demand. Weak consumption from the property sector is being countered by robust demand from other sectors.

Atop a potential share price rebound following this year's sell-down, BHP shares trade on a fully franked dividend yield of 5.4%.

As always, whether you're looking at buying BHP or any other ASX stock, make sure to do your own extensive research first. If you're uncomfortable with that or just short on time, then reach out for some expert advice.