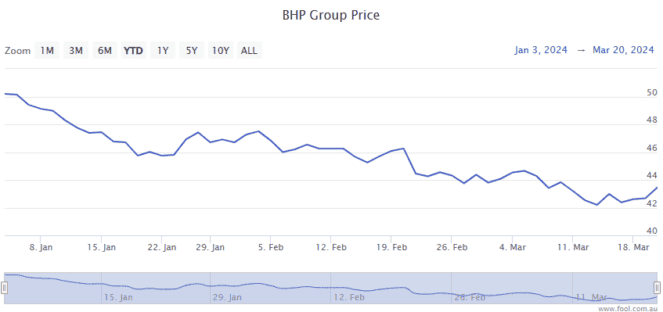

After closing flat on Monday, the BHP Group Ltd (ASX: BHP) share price charged higher over the following three trading days, before giving back some of those gains on Friday.

All told this saw shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner finish the week up 2.8%, smashing the 1.6% gains posted by the benchmark index.

Rival iron ore miners Rio Tinto Ltd (ASX: RIO) and Fortescue Metals Group Ltd (ASX: FMG) also handily outpaced the ASX 200.

Rio Tinto shares closed the week up 2.8%. Fortescue shares led the pack, gaining 4.5% since the opening bell on Monday.

Here's what sent the BHP share price charging higher.

What boosted the BHP share price?

The biggest tailwind helping the ASX 200 miners outperform over the week was the rebounding iron ore price.

On Friday 15 March, the industrial metal dipped below US$100 per tonne. At market open on Friday 22 March, that same tonne was trading for US$109.15.

The steel-making metal, along with the BHP share price, surged over the week following some promising economic data out of China, Australia's top export market.

While China's steel-hungry property markets remain weak, industrial production in January and February increased 7% year on year. That far exceeded consensus estimates of a 5% increase.

On the back of that data, Australia and New Zealand Banking Group Ltd (ASX: ANZ) analysts Daniel Hynes and Soni Kumari forecast that iron ore prices have bottomed for 2024.

"Iron ore prices may be near a floor amid a reset in expectations around [China's] demand," they said. "Weak consumption from the property sector is being countered by robust demand from other sectors."

Those other steel-hungry sectors include infrastructure and renewables investments, social housing, and the nation's massive car manufacturing industry.

Then there's copper, BHP's second biggest revenue earner after iron ore.

The red metal gained 1% over the week gone by, trading for US$8,950.50 at market open on Friday.

Now what?

Despite the strong weekly performance sending BHP back to $43.79 a share, a number of analysts remain bullish on the outlook for the ASX 200 iron ore miner.

Earlier in March, Citi upgraded its rating for BHP stock to a buy with a $46 target for the BHP share price.

That represents a potential 5% upside from Friday's closing price.