Not everyone is earning a fully franked 36% yield from this ASX dividend share.

But some forward-looking passive income investors certainly are.

The company in question is ASX coal stock Yancoal Australia Ltd (ASX: YAL).

Yancoal stock closed up 2.3% yesterday, ending the day trading for $5.37 a share.

On the passive income front, the headline-making dividends the ASX coal share paid in 2022 and the first half of 2023 have come back to earth. That's come alongside the big retrace from the record coal prices during that period.

For its full year 2023 results, Yancoal reported a 39% year on year decrease in its realised coal price to AU$232 per tonne. Despite a 14% annual increase in attributable saleable coal production, this saw revenue slide to $7.8 billion from $10.5 billion in 2022.

Still, the ASX dividend share ended 2023 with an enviable cash balance of $1.4 billion.

And the Yancoal board declared a $429 million, 32.5 cent per share, fully franked final dividend. Eligible passive income investors can expect to see that land in their bank accounts on 30 April.

Atop the interim dividend of 37 cents per share, paid on 20 September, that equates to a full-year payout of 69.5 cents per share.

Meaning Yancoal trades on a fully franked yield of 13.0%.

Very tidy.

Yet these forward-looking investors are earning far more from this ASX dividend share.

Here's how.

Mining a 36% yield from this ASX dividend share

In the wake of the COVID pandemic, with travel and industry across the world widely shuttered, energy prices plunged.

By September 2020 this drove thermal coal prices below US$55 per tonne. That's compared to around US$130 per tonne today and down from highs of some US$440 per tonne in September 2022.

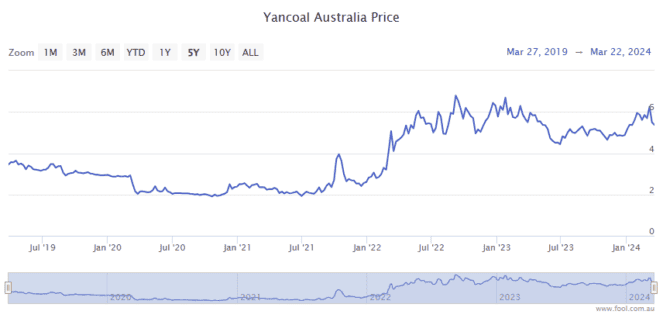

Alongside the plunging coal price, this ASX dividend share saw its stock heavily sold off as fear gripped the markets.

Shortly before things began to turn around, on 6 November 2020, the Yancoal share price closed at $1.92.

Many investors still steered clear, fearing it could be 'a falling knife'. But some forward-looking passive income investors took the plunge and bought Yancoal shares at what turned out to be a bargain basement price.

Over the past years, those investors will have earned the same dividends from those shares as investors who bought at far higher prices.

As for the past 12 months, at $1.92 per share, that equates to a fully franked yield of 36.2%!

Now, whether you're looking at buying Yancoal or any other ASX dividend share, be sure to do your own detailed research first. If you're short on time or don't feel comfortable with that, just reach out for some expert advice.