Against the grain of a bullish market, there are some quality companies that have dropped out of favour recently.

They might be fighting through a one-off difficulty or adverse external conditions that are out of their control.

Regardless, I think these three cheap ASX shares deserve a fair go because their long-term business prospects remain solid:

Reporting season blues

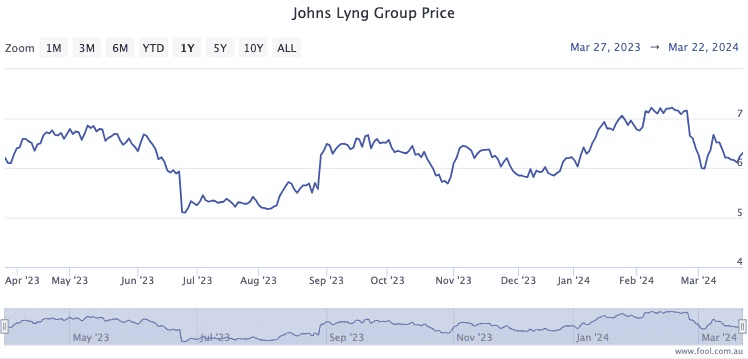

Johns Lyng Group Ltd (ASX: JLG) shares plunged 20% in a single morning late last month after its half-year results were revealed.

That was despite an upgrade guidance for the current financial year.

Sales revenue and net profit after tax (NPAT) for the first half were both down year-on-year, which may have triggered the disappointment.

Five investment houses did cut their share price expectations over the next year, but CMC Invest shows 9 out of 11 analysts still rating Johns Lyng as a buy.

I think it's an excellent opportunity to pick up a quality company for cheap.

Nothing doing here

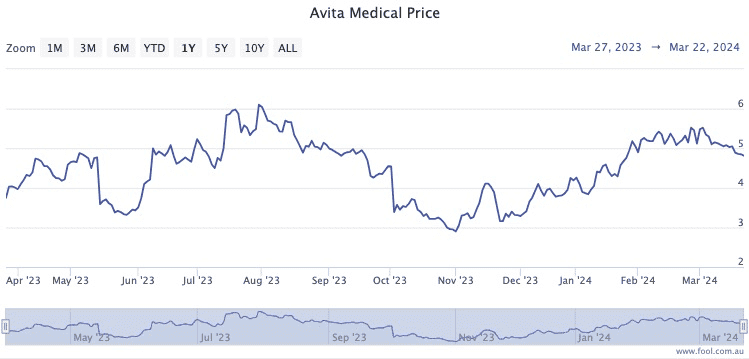

Regenerative medicine producer Avita Medical Inc (ASX: AVH) has seen its share price drop more than 12.3% since market close on 1 March.

No significant news has come out of the company, so one can only assume the valuation is changing from general market movement for biotechs.

If anything, Avita shares should be seeing increased demand because of its addition to the All Ordinaries Index (ASX: XAO) on 18 March.

The professional community is sticking firm on these cheap ASX shares.

Nine out of 10 analysts covering the stock rate it as a buy, according to CMC Invest, with eight of those considering Avita a strong buy.

These cheap ASX shares are still a value buy

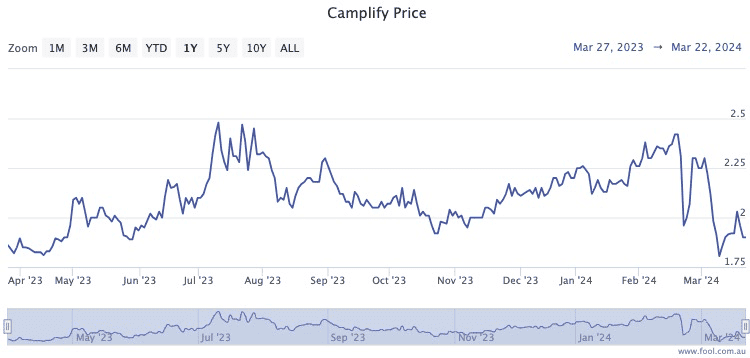

Like Johns Lyng, Camplify Holdings Ltd (ASX: CHL) shares were also burnt during reporting season.

"The stock closed down ~17% on result day, which we largely attribute to some seasonality in Camplify's key headline metrics (future bookings, gross margins, etc)," said the analysts at Morgans.

With the seasonal nature of the numbers, there has not been much movement in the opinions of fund managers in it for the long haul.

"Our price target remains unchanged and we maintain an add recommendation on the stock," said the Morgans team.

Indeed all three analysts covering Camplify still rate it as a strong buy, as shown on CMC Invest.