The Fortescue Metals Group Ltd (ASX: FMG) share price is leaping higher on Monday.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed Friday trading for $24.64. In morning trade shares were swapping hands for $25.96, up 5.4%.

At the time of writing, shares are trading for $25.65, up 4.1% for the day.

The strong performance comes despite a dip in the iron ore price over the weekend, with the industrial metal slipping 1.6% to US$108.05 per tonne.

And the Fortescue share price is racing ahead of rival ASX 200 miners BHP Group Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO). BHP shares are up 0.8% and Rio Tinto shares are up 0.9% at this same time.

This comes following the announcement of a million tonne milestone in Fortescue's sustainable mining transition.

Fortescue share price charges higher as low emissions mining takes form

Digging up a million tonnes of ore without belching out clouds of diesel smoke?

Yep, that's what Fortescue has just achieved at its Chichester iron ore operations, located in Western Australia.

In a press release on Friday that could be helping boost the Fortescue share price today, the ASX 200 miner reported its recently deployed electric excavator has now moved one million tonnes of material since going into action.

Initially operating at partial capacity, it's now full speed ahead for the electric excavator.

Management reported that at times the excavator was performing better than its diesel equivalent. The miner says the focus now is to ensure consistent performance from the machine.

"This is such an exciting milestone for Fortescue and our decarbonisation journey," CEO Dino Otranto said of the development which may be helping spur the Fortescue share price today.

And there's more to come.

According to Otranto:

We will have two additional electric excavators commissioned by the end of April. Once we decarbonise our entire fleet, around 95 million litres of diesel will be removed from our operations every year, or more than a quarter of a million tonnes of carbon dioxide equivalent.

The excavator has been running partially off solar and is powered by a 6.6kV substation and more than two kilometres of high-voltage trailing cable.

Fortescue's 240-tonne battery electric haul truck prototype, Roadrunner, is also progressing towards full field work.

"Roadrunner recently completed its first phase of testing which exceeded the performance expectations of the battery power system," Otranto said.

Copper expansion options

Separately, ASX 200 investor interest may have been sparked by Fortescue founder Andrew Forrest's speculation of pending copper acquisitions.

Speaking in Beijing over the weekend, Forrest told Reuters (courtesy of Mining.com), "The company has choices in front of it … we have a lot of copper options on the table. And when we feel the time is right, we'll pull the trigger."

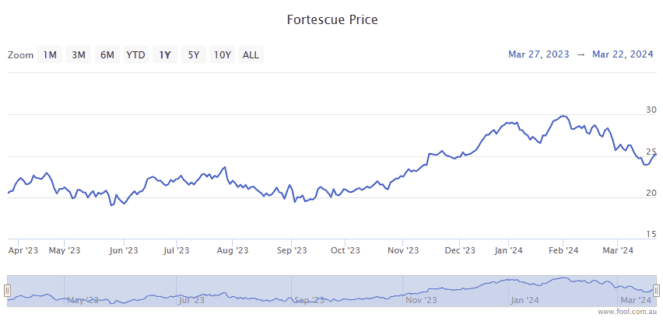

The Fortescue share price is up 26% since this time last year.