The Reserve Bank interest rate decision might be behind us, but there are still plenty of developments coming this week that are worth watching for the sake of your ASX shares.

eToro market analyst Josh Gilbert has picked out the three most important ones for our convenience:

1. Australia monthly inflation

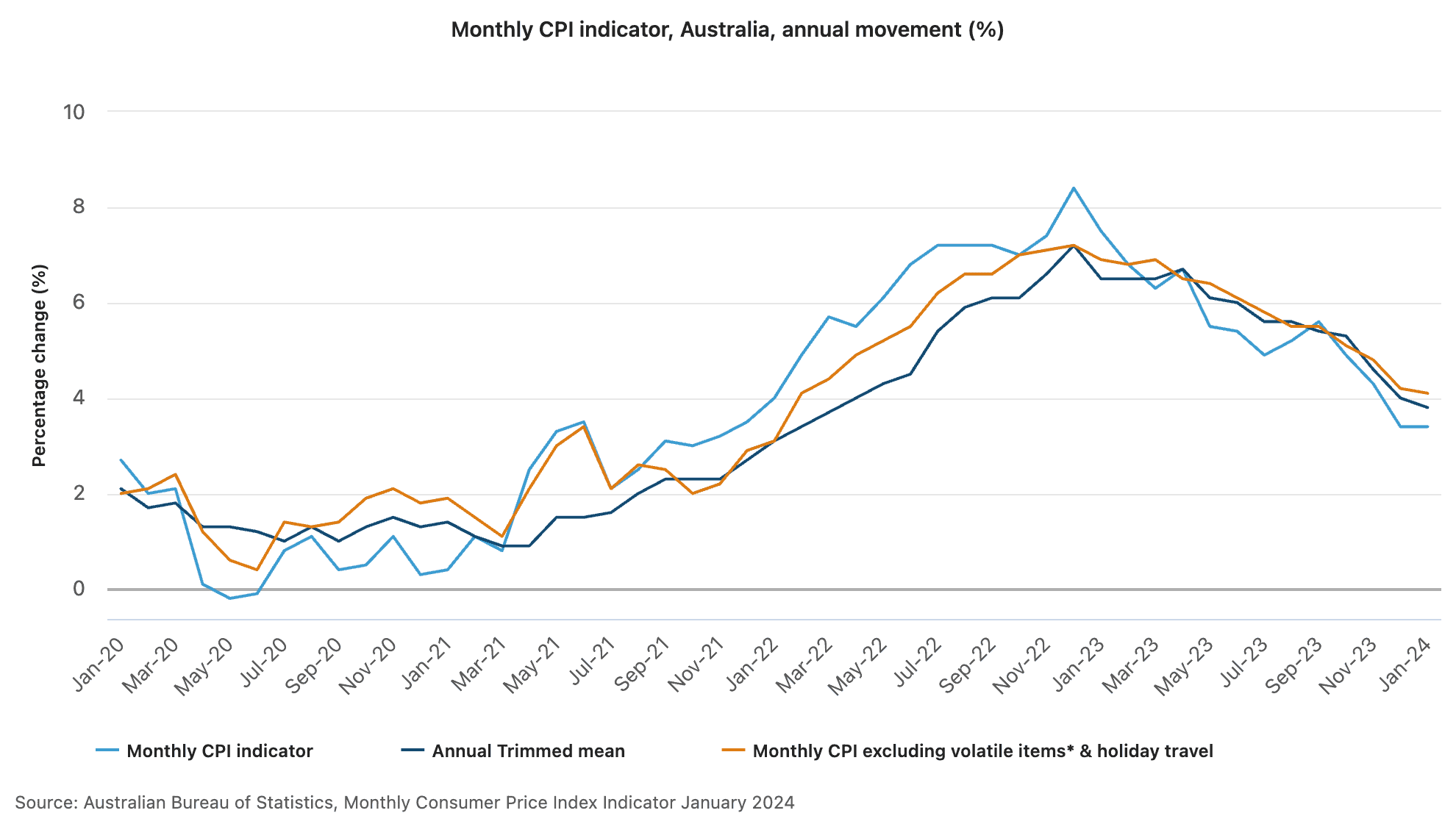

Wednesday will see the latest monthly consumer price index numbers released, which will be crucial in helping the RBA decide what to do with interest rates.

According to Gilbert, it's a given now that a rate cut will be coming this year.

"The market now sees an 80% chance the RBA will cut rates in August. However, the higher-for-longer take from the board can't be ignored by investors."

Inflation is the most important metric for all central banks around the world now, not just the Reserve Bank.

"Investors are looking at the rotation to come as we get nearer rate cuts, moving away from the US dollar and tech into cheaper and more cyclical assets."

2. Australia consumer confidence

Last month the consumer confidence index headed upwards to 86, according to Gilbert, which is the highest seen in two years.

"It's reasonable to anticipate a similar trend in March, considering the monthly CPI for January saw consumer prices rise 3.4%, going against economists' expectations of a slight increase from December."

The resilience and confidence shown by Australian consumers could be working against them though.

"The market is pushing back on the number of rate cuts this year," said Gilbert.

"In early February, the market was expecting more than two cuts, which has since been pushed to under two cuts."

3. BYD financial report

The world's biggest selling electric car maker, BYD (SHE: 002594), is reporting its latest results on Tuesday.

"Investors are eagerly anticipating the automotive company's earnings, which BYD expects to have risen by up to 85.6% year-on-year for 2023," said Gilbert.

"However, the company's preliminary income figures fell short of market expectations, which could create an interesting dynamic around the earnings announcement this week."

Gilbert pointed out that Australians may have noticed many more BYD cars driving around this year.

"BYD is set to deliver more than 3 million cars for the full year 2023.

"Whether BYD can leverage its growth potential to carve out a larger market share remains to be seen. The upcoming earnings report will likely shed more light on this subject, providing key insights into BYD's strategic direction and financial health."