Owning Wesfarmers Ltd (ASX: WES) can be very rewarding in terms of the passive income we get. In this article, we're going to look at how many Wesfarmers shares we need to get $100 of monthly dividends.

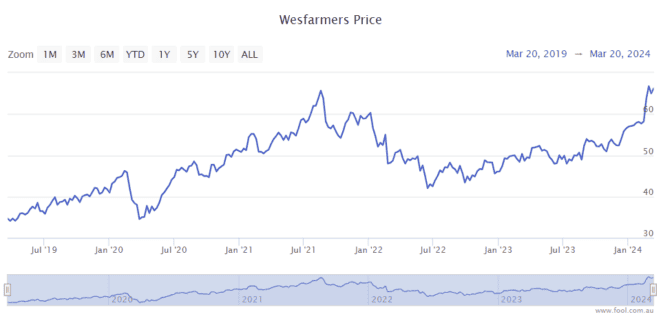

The business has delivered lots of capital growth recently, and over the long-term. In the past six months, it has risen 24%, in the last year it has gone up 35% and in the past five years it has climbed 90%.

Wesfarmers dividend forecast

The company wants to grow its dividend each year for shareholders if it can and if it has made enough profit to do so.

Looking at the estimates on Commsec, Wesfarmers is predicted to grow its dividend per share to $1.95, which would be a year-over-year increase of 2%.

The projection on Commsec suggests it could grow its annual dividend per share to $2.35 by FY26, which would be a 20% rise between FY24 and FY26.

How many Wesfarmers shares are needed for $100 of passive income per month?

Wesfarmers usually pays a dividend every six months, not monthly. Therefore, it's better to think about the goal as $1,200 per year.

How many Wesfarmers shares do we need to own for $1,200 per year? If Wesfarmers does pay a dividend per share of $1.95, we'd need to own 616 Wesfarmers shares (for a cost of $40,755). If we include the franking credits as part of the annual income, we'd need 431 Wesfarmers shares (for a cost of $28,515).

Can the payout keep growing?

In the FY24 first-half result, Wesfarmers' board decided to increase its interim ordinary dividend per share by 3.4% to 91 cents.

It had a decent start to the financial year despite the difficult trading conditions amid the high cost of living for Australians. HY24 revenue increased 0.5% to $22.67 million, and net profit after tax (NPAT) rose 35% to $1.4 billion.

Kmart Group and Bunnings continue to deliver growth, with Kmart performing particularly well as customers look for good value. In the first five weeks of the second half of FY24, Kmart Group has "continued to deliver strong sales growth".

It seems there is a good chance of dividend growth this year and beyond, particularly when interest rates start coming down, which could help households' finances.

Wesfarmers shares are certainly one of the stocks I'd like to have in my portfolio for passive income.