The S&P/ASX 200 Index (ASX: XJO) is flat in afternoon trade, but that's not holding this Australian dividend stock back.

The stock in question is ASX 200 gold miner Northern Star Resources Ltd (ASX: NST).

Northern Star shares closed yesterday trading for $13.65. At the time of writing, shares are swapping hands for $13.82 apiece, up 1.3%, having earlier posted gains of more than 1.5%.

The Australian dividend stock looks to be getting a boost from an overnight uptick in the gold price. The yellow metal is trading for US$2,162 per ounce (AU$3,297).

That sees most ASX gold stocks outperforming today, as witnessed by the 1.4% gain posted by the S&P/ASX All Ordinaries Gold Index (ASX: XGD).

What's been happening with this Australian dividend stock?

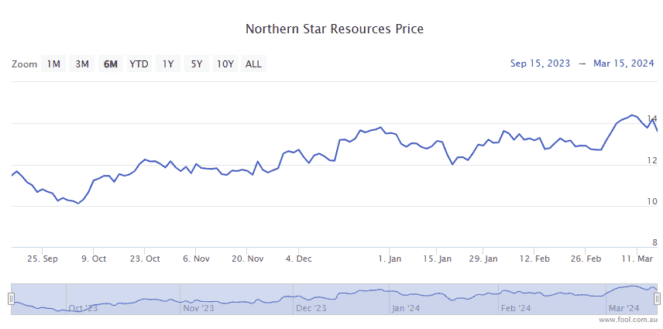

The Northern Star share price has been on a strong upward trend since early October.

In fact, the Australian dividend stock has gained a whopping 38% since 3 October when shares closed the day trading for $10.04.

The ASX 200 gold miner has enjoyed a big lift in bullion prices over that time. On 5 October, gold was fetching US$1,820 per ounce, 18.8% below today's levels. And most of those gains will find their way into Northern Star's bottom line.

Northern Star also reported some very solid results for the six months ending 31 December.

That was driven by a big increase in the miner's average realised gold price from AU$2,513 per ounce in the prior corresponding period to AU$2,873 per ounce over the second half of 2023.

Highlights of the half year included a 15% increase in revenue to $2.25 billion. And cash earnings leapt 50% to an all-time high of $702 million.

That saw the Australian dividend stock please passive income investors with a record interim unfranked dividend of 15 cents per share, up 36% from the prior interim dividend.

This brought the full-year dividend payout to 30.5 cents per share. At the current Northern Star share price, the gold miner trades at an unfranked trailing yield of 2.2%.

And with gold prices having breached new all-time highs in March, and continuing to trade near those highs, the outlook for more dividend growth and potential new record payouts looks good.