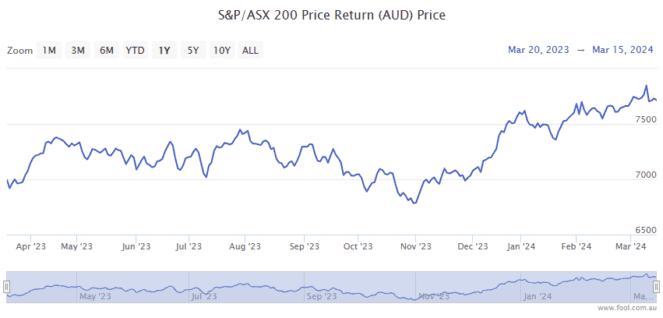

The S&P/ASX 200 Index (ASX: XJO) is in the red on Monday.

After closing down 0.2% on Thursday and slipping another 0.6% on Friday, the benchmark Aussie index is down 0.3% at time of writing today at 7,643.0 points.

This comes after the ASX 200 thrilled investors, though perhaps not short sellers, when it notched a number of new record highs earlier this month.

The sharemarket has been buoyed by relatively strong earnings results from many of the top companies as well as investor hopes of pending interest rate cuts from the Reserve Bank of Australia and the US Federal Reserve.

The most recent closing high was reached on Friday, 8 March. The ASX 200 closed the day trading for 7,847.0 points. That saw it up a whopping 15.7% from the recent 31 October lows.

So, why is the index retreating from record highs?

Why is the ASX 200 down from all-time highs?

The answer has very little do with the individual companies listed on the ASX 200.

Instead, it involves growing investor fears that sticky inflation will lead to higher interest rates for longer than the markets have been pricing in.

Indeed, the stubbornly absent and persistently low inflation 'problems' of yesteryear are well and truly behind us.

Ah, nostalgia.

Last week's US inflation readings surprised most economists to the upside.

February's US producer price index (PPI) increased by 0.6% from January, double consensus expectations. And the consumer price index (CPI) in the US increased by 0.4% after a 0.3% month on month increase in January.

And with energy costs on the way back up, markets are beginning to wake up to the fact that inflation may well remain elevated longer than hoped.

Fears that this could delay interest rate cuts from the US Fed also have seen the S&P 500 Index (SP: .INX) and Nasdaq Composite Index (NASDAQ: .IXIC) retrace from their own record highs posted in March.

The S&P 500 closed down 0.7% on Friday, while the tech-heavy Nasdaq dropped by 1.0%.

Commenting on the inflation data throwing up headwinds for US markets and the ASX 200, Stephen Miller, a markets strategist at GSFM said (quoted by The Australian Financial Review):

Markets have begun to scratch their heads on just how Goldilocks the scenario ahead is going to be. When the Fed meets next week, I won't be surprised to see cuts in the dot plot tempered a bit, and I still don't think the equity markets have got their head around that.

Barrenjoey chief economist Jo Masters added:

It's clear inflation looks like it's a bit of sticking point, and the market was already so aggressively priced. Turning points in economies are never smooth, and we always expect the data to be a little bumpy.

The RBA announces its next interest rate decision tomorrow at 2:30pm AEST.

ASX 200 investors have widely priced in a hold from the central bank, with 95% of investors expecting no change from the current 4.35% rate.

But investors continue to expect one or more rate cuts from the RBA (and as many as three from the Fed) in 2024.

Which could make the past few days retrace a prime time to go shopping for bargain ASX 200 shares.