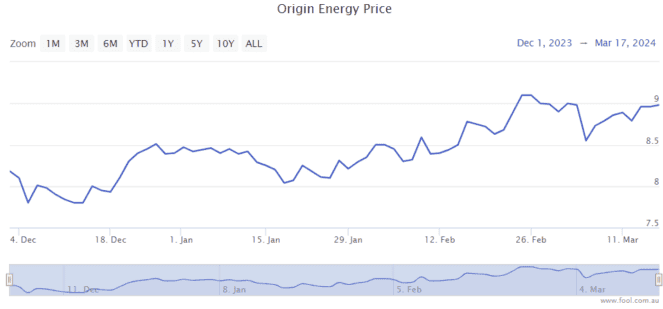

The Origin Energy Ltd (ASX: ORG) stock price has climbed 14% in three months. That compares to a 3.3% rise for the S&P/ASX 200 Index (ASX: XJO).

Despite the company's rise, some people believe the ASX energy share can keep climbing.

The Origin Energy stock price has suffered in the last three months of 2023 after the takeover attempt by Brookfield was denied by shareholders, including AustralianSuper.

More gains to come?

AustralianSuper built a large stake in the business and was influential in blocking the takeover going ahead.

Some investors were focused on the issue of the environment – would the planet be better off if Origin was under the control of Brookfield or remained a listed business? AustralianSuper's CEO Paul Schroder was quoted by The Australian saying the following:

We had some really good engagement with (Origin). But I do want to call out some behaviour which was despicable.

For people to say that funds who have one view or another were either 'wreckers'

of the environment or not, or some other spurious kinds of things that were talked

about.We're investors, we think it's a great company with great assets and good management. We think it's worth more. That's it.

AustralianSuper is convinced that Origin will play a "significant role" in the energy transition.

It may cost many billions to get Australia to net zero over the decades, but Origin could be one of the key contributors.

Schroder then said:

I think we (AustralianSuper) and Brookfield think exactly the same about how

much it's worth, and they just had a view about how much they could get it for,

basically.We have a very strong conviction about the future of that company.

How valuable is Origin Energy stock?

Ultimately, it's up to each investor to decide what the ASX energy share is worth.

Brookfield was trying to buy Origin for $9.39 per share. That's currently 3% higher than where it is right now, which isn't much of a possible rise, though AustralianSuper thinks it's worth more.

According to the estimates on Commsec, the Origin Energy stock price could be valued at just 11 times FY25's estimated earnings.

The business will need to balance profitability with investing in renewable energy. There's a large opportunity for big players, but I think there are a number of other ASX shares that aren't as capital-intensive and more attractive.