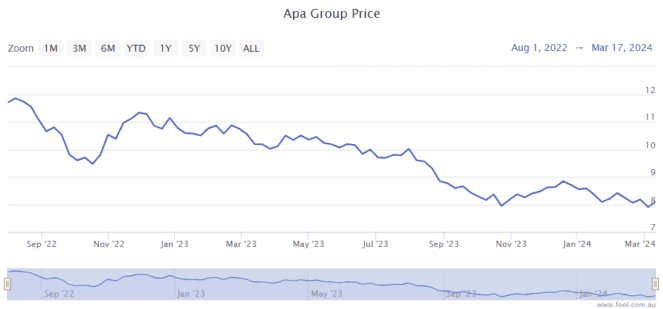

The ASX dividend stock APA Group (ASX: APA) has suffered a large sell-off. It's down 19% in the past year, and down 30% from August 2022, as we can see on the chart below.

For readers who haven't heard of this large infrastructure business, it's the owner of a very large gas pipeline network around Australia. APA transports half of the country's natural gas usage.

It also owns or has interests in gas storage facilities, gas-fired power stations and renewable energy generation (solar and wind).

Attractive dividend yield

Large swathes of the ASX share market have gone up in recent months, pushing plenty of names to near all-time highs. This has the unfortunate effect of pushing down the dividend yield.

However, with the lower APA share price, it has seen its distribution yield increase.

A falling share price of a normal ASX dividend stock can be a warning sign of a potential falling profit and dividend cut. But, APA has increased its distribution every year since 2004, and I think this streak can continue.

The business is expecting to pay a distribution per security of 56 cents in FY24, which would be an increase of 1.8% compared to FY23. This payout would translate into a distribution yield of 6.8%.

Ongoing income growth

APA's distribution is paid for by the ASX dividend stock's cash flow, with revenue being a key driver.

A large majority of APA's revenue growth is linked to inflation. The last couple of years of high inflation have led to accelerated revenue for the business.

In the FY24 first-half result, revenue increased 3.4% to $1.27 billion, but the 'segment revenue' increased 8.2% to $1.27 billion. This helped underlying earnings before interest, tax, depreciation and amortisation (EBITDA) grow 5.8% to $930 million and free cash flow increased 12.8% to $546 million.

APA is also working hard on growing its pipeline, with bolt-on projects. Each new project can grow its cash flow once it's completed.

The business is also steadily growing its portfolio of renewable energy and electricity transmission assets.

Foolish takeaway

I don't think this business is going to deliver huge capital growth, but I believe it is very capable of delivering ongoing rising annual distributions, which would be a very useful characteristic in an uncertain world, particularly if interest rates start being cut in the next 12 months.

With a large starting yield and a growing payout, I think the business is an appealing ASX dividend stock, along with others.