Notwithstanding Friday's nasty dip of 0.56%, the S&P/ASX 200 Index (ASX: XJO) is sitting just 182.8 points shy of its all-time high right now. Therefore, finding cheap ASX shares to snap up can be a tough ask!

But our Foolish writers, who live and breathe the Aussie share market, are always up for a stock-picking challenge.

So, we asked them to pop their bargain-hunting hats on and let us know which ASX shares they reckon have been unfairly sold off and now represent top buying for investors in March.

Here is what they told us:

5 cheap ASX shares for March 2024 (smallest to largest)

- Adairs Ltd (ASX: ADH), $420.51 million

- Johns Lyng Group Ltd (ASX: JLG), $1.73 billion

- IDP Education Ltd (ASX: IEL), $5.38 billion

- Telstra Group Ltd (ASX: TLS), $43.79 billion

- Woodside Energy Group Ltd (ASX: WDS) $55.33 billion

(Market capitalisations as of market close 15 March 2024).

Why our Foolish writers think these ASX stocks are bargain buys

Adairs Ltd

What it does: Adairs is an ASX 200 retail share and a brand you've probably seen in your local shopping centre. It sells linens, bedding, towels, furniture, and other homewares.

By Sebastian Bowen: Adairs is a company I've been tracking for the past few months with delight. Fresh off the lows we saw last year, investors have enjoyed some pleasing gains since November. However, the retailer is still well off its all-time highs of almost $5 a share we saw in 2021.

I think Adairs has what it takes to get back to its former glory. The company's finances are steadying, and dividends have resumed. I'm also encouraged by the recent management shakeup.

I wouldn't be surprised to see the Adairs share price with a '$3' at the front by the end of 2024.

Motley Fool contributor Sebastian Bowen owns shares of Adairs Ltd.

Johns Lyng Group Ltd

What it does: Johns Lyng provides construction and repair services, with work coming from insurance claims a major part of its business.

By Tony Yoo: The Johns Lyng share price has dipped around 13% since 26 February, and 32% if you go back to April 2022.

This might present an excellent buying window for a quality company that's demonstrated an ability to grow and execute. Moreover, the nature of the business means it receives more work as extreme weather events become more frequent due to climate change.

The market was disappointed with the company's earnings and profit coming out of reporting season. But they were not, in my opinion, signalling any chronic decline.

The company's future outlook has major backing from the professional community, with nine out of 11 analysts currently surveyed on CMC Invest rating Johns Lyng as a buy.

Motley Fool contributor Tony Yoo owns shares of Johns Lyng Group Ltd.

IDP Education Ltd

What it does: IDP Education is a leading provider of international student placement services and high-stakes English language testing services.

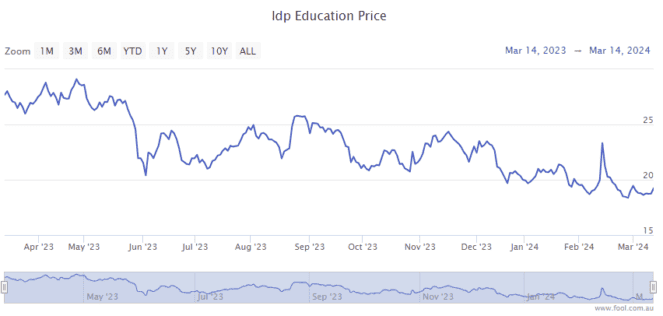

By James Mickleboro: Due to concerns over student visa changes in a number of markets and the loss of its language testing monopoly in Canada, investors have been scrambling to the exits over the last 12 months. This has led to the IDP Education share price shedding around 30% of its value during this time.

I believe this presents a buying opportunity for investors, particularly given I'm confident the company will continue its strong growth in the coming years despite these challenges.

Goldman Sachs also believes this will be the case. For example, it is forecasting earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $322 million in FY 2024, $352 million in FY 2025, and $404 million in FY 2026. Goldman has a buy rating and a $26.60 price target on IDP Education shares.

Motley Fool contributor James Mickleboro does not own shares of IDP Education Ltd.

Telstra Group Ltd

What it does: Telstra is the largest telecommunications business in Australia, with a leading market share in the mobile space of the market.

By Tristan Harrison: The Telstra share price has gone backwards in recent months, but the company's profit has been increasing. This means the price/earnings (p/e) ratio is now lower and more appealing.

I think any business that is sustainably growing its profit could present an interesting investment opportunity. Telstra is benefitting from more subscribers and a higher average revenue per user (ARPU) because of price hikes. Furthermore, the company is keeping underlying cost growth to a minimum, despite the headwinds of inflation. That combination is helping profit growth.

In FY25, Telstra is predicted (according to Commsec) to pay an annual dividend of 19 cents per share, which represents a grossed-up dividend yield of 7.1% on current pricing.

I think profit can keep rising with more subscribers, diversifying earnings (eg. Digicel Pacific, digital health and cybersecurity), and a growing number of households using 5G-powered home internet (rather than the NBN).

Motley Fool contributor Tristan Harrison does not own shares of Telstra Group Ltd.

Woodside Energy Group Ltd

What it does: Woodside is Australia's largest independent dedicated oil and gas producer. The company has a portfolio of high-quality energy assets in Australia, the Gulf of Mexico, the Caribbean, Senegal, and Timor-Leste. Woodside continues to actively explore for new oil and gas deposits.

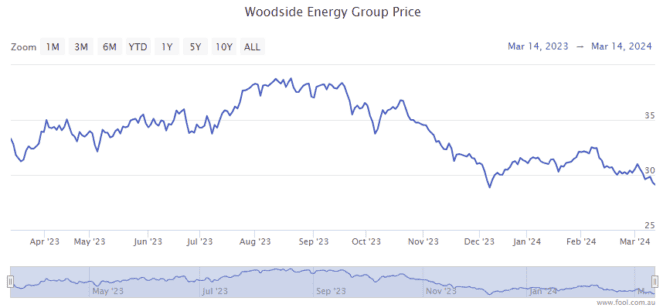

By Bernd Struben: The Woodside share price is down by around 22% in the last six months. Much of that selling pressure came amid a retrace in global oil and gas prices, with Brent crude now trading for US$82 per barrel.

But with global demand forecast for modest growth and OPEC+ sticking with production cuts, the US Energy Information Administration forecasts oil will top US$88 per barrel this quarter and average US$87 over 2024. The EIA also expects LNG prices to be higher than in 2023.

And with Woodside's offshore Scarborough LNG project on track for first production in 2026, the longer-term outlook also looks solid.

Atop potential share price gains, Woodside shares trade on a fully-franked dividend yield of 7.3%.

Motley Fool contributor Bernd Struben does not own shares of Woodside Energy Group Ltd.