ResMed Inc (ASX: RMD) stock closed at $29.15 on Friday, up 0.59% for the day.

The sleep apnoea device maker has had a tumultuous time on the ASX boards over the past nine months.

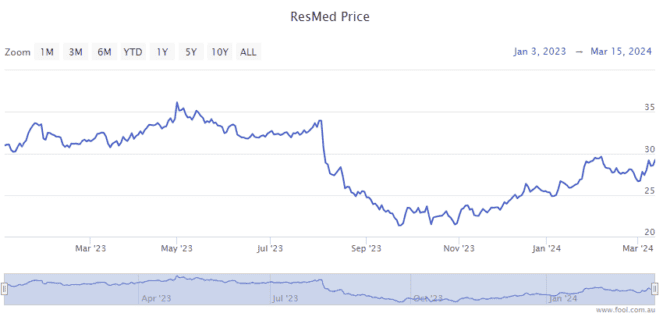

As the chart shows below, ResMed stock experienced a significant sell-off in the second half of 2023.

The ASX 200 healthcare stalwart fell from $33.85 on 3 August to a four-year low of $21.14 on 13 October.

What caused the ResMed stock tumble?

The tumble was primarily caused by two things.

Firstly, a broader sell-off in ASX healthcare stocks, which commenced in June 2023.

Secondly, investors' concerns over GLP-1 obesity drugs like Ozempic.

Their fear was that the highly effective weight loss medicines would lower demand for sleep apnoea devices given obesity is a common precursor to sleep apnoea.

During the height of this sell-off in October, ResMed CEO Mick Farrell sought to reassure investors.

He reminded them that the sleep apnoea market was huge and that not all sufferers have obesity.

He also told shares investors that RedMed was proactively tracking the potential future impact of Ozempic and GLP-1 medicines on the business, and even dared to quantify it.

Based on internal modelling, Farrell said GLP-1s may reduce the total addressable market (TAM) for sleep apnoea and ResMed's products from 1.4 billion to 1.2 billion by 2050.

So, the company reckoned GLP-1s could cost them 200 million people in terms of TAM.

But at that stage, he said they were not seeing any declining use of ResMed products among patients using both GLP-1s to treat their obesity and ResMed's devices to treat their sleep apnoea.

He pointed out that ResMed had 22.5 million customers using its devices at that time, which was a drop in the ocean of a 1.2 billion TAM.

Farrell said the company would continue to monitor the impact of GLP-1s, and we got another update when the last set of results was released in January.

And guess what?

Surprise! GLP-1s increase the use of ResMed devices

Farrell surprised analysts during their call by revealing that ResMed's research was revealing a positive impact from GLP-1s.

The CEO said:

Our analysis of over 529,000 patients with GLP-1 prescriptions shows that not only is there not a reduction in the propensity to start positive airway pressure therapy, it is the exact opposite.

For patients who have been prescribed a GLP-1, there is an increase of 10% of the absolute percentage of patients that commence positive airway pressure therapy.

Farrell said another investor fear had been that patients on both therapies would quit their sleep devices use at a higher rate than the general population over time.

He said:

The real world data, again, with a cohort of over 0.5 million patients shows the exact opposite.

At … 12 months after therapy commencement on PAP, the delta from general PAP population to a PAP plus GLP-1 prescribed population shows an increase in the resupply rate of 300 basis points.

This delta actually increases over time going further with the delta from the general PAP population receiving resupply at 12 months being 500 basis points higher for a population prescribed both PAP and GLP-1s.

ResMed stock price recovery

ResMed stock began an impressive recovery during the Santa Rally that began in November 2023.

Since 1 November, the ASX 200 healthcare stock has rebounded by 34%.