This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) won over Wall Street last year, illustrated by its more than 280% stock growth since March 2023. The company's years of dominance in graphics processing units (GPUs) perfectly positioned it to profit significantly from a boom in artificial intelligence (AI) as demand for the chips skyrocketed. As a result, Nvidia's quarterly revenue and free cash flow are up 207% and 430%, respectively, in the last 12 months.

The company's meteoric rise has some analysts questioning whether the company has much more to offer investors in 2024. However, trends in the chip market indicate Nvidia will have little problem retaining its leading market share in AI GPUs, despite new offerings from Advanced Micro Devices and Intel.

Meanwhile, the AI market is nowhere near hitting its ceiling. It's projected to expand at a compound annual growth rate of 37% until at least 2030. The sector's potential indicates GPU demand is likely to continue rising for the foreseeable future, with Nvidia well-equipped to continue enjoying significant gains from AI.

Here's why Nvidia remains an attractive buy in March.

Nvidia will likely retain its AI dominance despite rising competition

Nvidia's success in the AI chip market has led to countless tech companies announcing ventures into the industry. Leading chipmakers AMD and Intel plan to begin shipping new GPUs soon in an attempt to challenge Nvidia's market share. Meanwhile, companies new to the sector are also joining in, as Amazon and Microsoft announced new AI chips last year.

However, market trends suggest Nvidia's supremacy will be challenging for competitors to overcome. The company has held an over 80% market share in desktop GPUs for years, despite AMD's and Intel's presence in the sector.

Intel only entered the industry last year, while AMD's history in desktop GPUs spans decades. Still, AMD's GPUs only account for about 10% of the market.

A similar situation has occurred in another area of the chip market. Intel was a king in central processing units (CPUs) for years, with an 82% market share at the start of 2017 when AMD landed on the scene with its Ryzen line of CPUs. AMD has managed to steal a significant share from Intel since then. However, Intel is still responsible for most of the CPU market; its share is above 60% and AMD's is at 36%.

Nvidia's estimated 80% to 95% market share in AI GPUs could falter slightly as competition heats up. However, history indicates the company will retain its overall lead and continue to see major gains from AI for years.

Projections show Nvidia's stock should continue beating the S&P 500

Nvidia has stunned Wall Street over the last year, posting multiple quarters of record earnings. In the fourth quarter of 2024 (ended in January), the company's revenue increased by 265% year over year to $22 billion. Meanwhile, operating income jumped 983% to nearly $14 billion. The monster growth was primarily from a 409% increase in data center revenue, reflecting increased chip sales.

While a spike in AI GPU sales is mainly responsible for Nvidia's stellar financial growth, the chipmaker is also profiting from an improving PC market. Spikes in inflation prompted steep declines in PC sales, with shipments dipping 16% in 2022 and continuing to fall for most of 2023. However, recent reports indicate the market is finally showing signs of recovery.

According to Gartner, PC shipments popped 0.3% in Q4 2023, marking the first such increase in over a year. Market improvements have been reflected in Nvidia's sales, with its PC-centered gaming segment reporting an 81% rise in revenue in Q3 2024 (which ended October 2023).

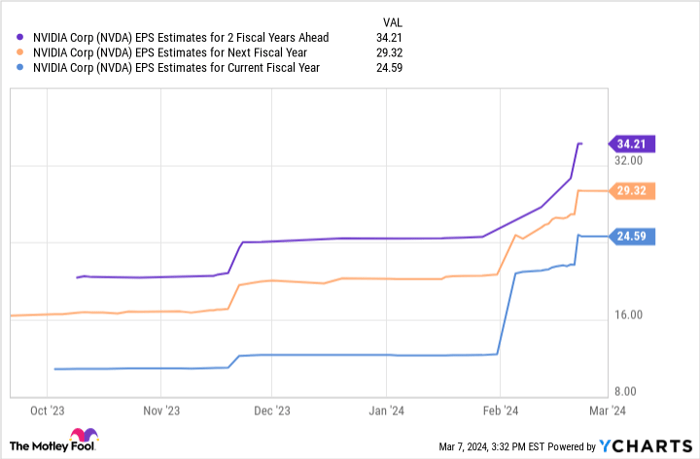

A leading role in AI and a recovering PC market suggests Nvidia has a strong outlook in the coming years. Earnings-per-share (EPS) estimates seem to support this.

Data by YCharts.

The above chart shows Nvidia's earnings could hit $34 per share by fiscal 2026. Multiplying that figure by its forward price-to-earnings ratio of 38 yields a stock price of $1,292.

Considering the company's current position, that projection would see Nvidia's stock rise 40% over the next two years. The company may not replicate last year's growth but would still beat the S&P 500's 22% growth since 2022.

As a result, Nvidia still has much to offer new investors and is an exciting buy right now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.