Arafura Resources Limited (ASX: ARU) shares came out of a trading halt and shot 60% higher on Thursday afternoon to 24 cents apiece.

The share price skyrocketing comes on the back of news the Federal Government has conditionally approved a US$533 million debt finance package to support Arafura's flagship project.

That's the Nolans Neodymium-Praseodymium (NdPr) Project in the Northern Territory. NdPr is used in electric vehicles (EVs).

Arafura shares have since slipped slightly to 22 cents per share, up 49.66% for the day.

The ASX rare earths developer returned to trading shortly after it released a statement to the market.

Let's review the details.

Arafura shares on fire amid massive government support

The debt finance package includes a US$125 million limited-recourse senior debt facility made available through the A$4 billion Critical Minerals Facility (CMF), which is administered by Export Finance Australia (EFA).

There's also A$150 million in limited-recourse senior debt facilities from the Northern Australia Infrastructure Facility (NAIF). Both facilities have a 15-year tenor.

EFA will also provide a subordinated Standby Liquidity Facility (SLF) of up to US$200 million under the CMF to help manage any increases in capital expenditure and operating costs during the project's ramp-up.

EFA also has conditional approval to provide further funding of up to US$75 million on its Commercial Account to participate in the ECA-covered tranches and Cost Overrun Facility (COF).

NAIF has agreed to provide additional funding of up to A$50 million via a proportion of the COF.

Company says more funding to come

Arafura said the government support was part of a broader financing package it has been seeking.

The company says it currently has indicative interest from international and commercial financiers for a further US$550 million of senior debt facilities.

Biggest critical minerals investment to date

As we reported earlier today, this is the Labor Government's largest single financial commitment in the critical minerals sector.

It brings taxpayers' exposure to rare earths mining and processing to more than $2 billion.

Previously, the government has supported the development of the Eneabba project owned by Iluka Resources Limited (ASX: ILU) in Western Australia.

Arafura share price snapshot

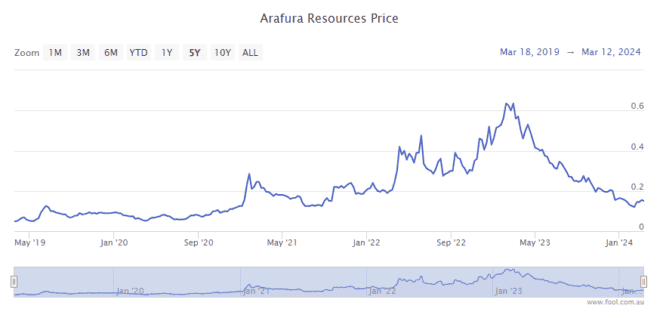

Arafura shares have fallen 59.5% over the past year.

By comparison, the S&P/ASX All Ordinaries Index (ASX: XAO) has increased by 10.9%.