ASX uranium shares have found favour among many investors over the past year, but there is one particular stock coming out of a trading halt that looks intriguing.

That's according to Auburn Capital head of wealth management Jabin Hallihan, who rates Deep Yellow Limited (ASX: DYL) as a buy.

"Deep Yellow is a uranium exploration and development company, with operations in Namibia and Australia," Hallihan told The Bull.

"The company boasts a substantial resource base and aims to achieve uranium production capacity of more than 7 million pounds a year."

$220 million capital raising

The stock went into a trading halt last Thursday, which was released on Monday morning.

The eventual announcement was that the company had successfully raised $220 million from institutional investors to fund both its Tumas project in Namibia and Mulga Rock in Western Australia.

According to Deep Yellow chief executive John Borshoff, the development is "timed perfectly".

"The Tumas Project represents a long-life high-quality asset timed to deliver into what is a supply constrained market," he said in a statement to the ASX.

"The Mulga Rock Project is next in the development schedule and provides a great opportunity to develop our second uranium mine that will also benefit from integrating the value-adding critical minerals and magnetic rare earth elements associated with these deposits."

The favoured uranium shares in a favoured industry

The uranium industry is bullish at the moment due to many nations reconsidering nuclear as a powerful source of emissions-free energy generation.

And within that industry Hallihan likes Deep Yellow as a buy for those investors willing to take on some risk.

"The company's experienced management team, coupled with its ambitious production targets and favourable cost projections, make it a speculative buy."

Broking platform CMC Invest shows four out of five analysts that cover the $936 million small-cap as a buy right now.

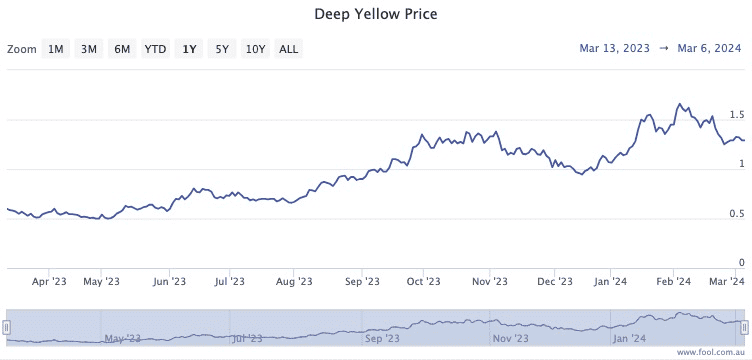

The Deep Yellow share price has more than doubled over the past year.