Most ASX dividend stocks only pay passive income investors cash twice per year.

That tends to be a month or so after announcing their half-year results (the interim dividend). And again a month or so following their full-year results (the final dividend).

Indeed, if you've run your slide rule over the companies making quarterly payouts you'll have found that list isn't overly large.

But there are a few quality, high-yielding ASX dividend stocks to consider if you're after a more regular passive income stream.

Which brings us to…

Reliable quarterly passive income from this ASX REIT

If you invest for passive income, you may be familiar with Rural Funds Group (ASX: RFF).

The real estate investment trust (REIT) holds and leases agricultural equipment and land, including cattle ranches, vineyards and cropping acreage.

And it has a long and growing track record of paying quarterly dividends.

Rural Funds reported its half year results on 23 February.

Highlights included a 19.5% year-on-year increase in earnings, which reached $71 million over the six months. That boost was spurred by a $4.6 million increase in property revenue, which came in at $42 million. Asset revaluations also helped increase Rural Funds earnings.

On the passive income front, the REIT declared an unfranked dividend of 2.9 cents per share.

The stock trades ex-dividend on 27 March, so there's still time to grab that quarterly payout. Eligible investors can then expect to see that passive income hit their bank accounts on 30 April.

The last three quarterly dividend distributions all came out to 2.9 cents per share as well. That equates to a full-year payout of 11.6 cents per share.

At Thursday's closing price of $2.13 per share, this works out to a dividend yield (partly trailing, partly pending) of 5.5%.

Looking ahead, Rural Funds forecast FY 2024 quarterly dividend payments will remain largely in line with the past quarters.

And the REIT aims to increase its passive income payouts each year from here.

Rural Funds notes that it targeted "distribution growth of 4% per annum by owning and improving farms that are leased to good counterparties".

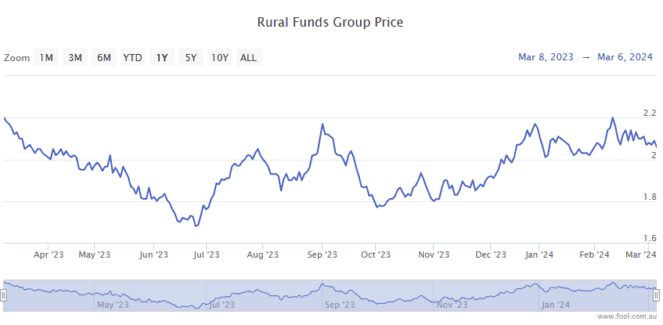

The Rural Funds share price is down 2% over 12 months and up 5% over the past six months.