The Insurance Australia Group Ltd (ASX: IAG) interim dividend announced last month was 67% higher than last year, at 10 cents per share.

That's some very nice turbocharged passive income, right there.

And analysts say it's only going to get better from here.

IAG dividend trajectory

So, IAG investors will be receiving their 10 cents per share on 27 March.

What's next?

Well, consensus expectations published on CommSec today are for IAG to pay a total dividend of 25 cents in 2024. That means the final dividend, to be announced in August, should be about 15 cents per share.

Last year, 15 cents was what IAG paid in dividends for the entire year. So, you get the drift. IAG dividends are on the increase.

Based on the IAG share price of $6.23 at the time of writing, a total dividend of 25 cents this year would equate to a dividend yield of 4%.

This is nothing spectacular — 4% is the average dividend yield for S&P/ASX 200 (ASX: XJO) stocks.

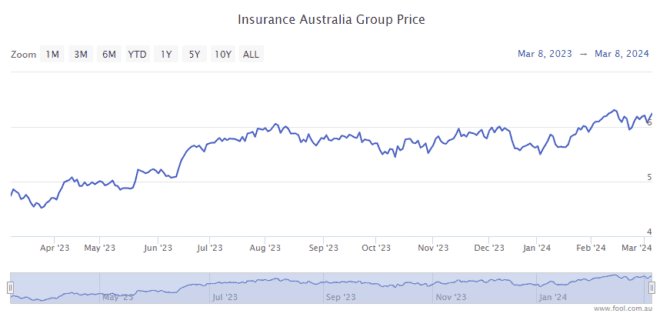

But we need to remember that the IAG share price has had a significant run-up of late. Over the past 12 months, it's up 30%. That sort of price growth is obviously going to lower the yield.

What about future IAG dividends?

The consensus forecast is for IAG to pay a total annual dividend of 30 cents in 2025 and 32 cents in 2026. That means yields of 4.8% and 5.1%.

That's better!

And don't forget about the franking on top. In 2023, the annual dividend had 30% franking attached. The recent interim dividend for 2024 had 40% franking attached.

Should you buy?

After 30% share price growth, some investors might like to wait for the next pullback in price.

To give you some guidance, the consensus rating is currently a hold. The rating was downgraded from a moderate buy this week.

Goldman Sachs has a 12-month share price target of $6 on IAG shares. So, the broker reckons IAG shares are already trading above value today.

Over to you.