S&P/ASX 200 Index (ASX: XJO) bank shares have been on a tear over the past six months.

And a growing number of analysts are cautioning that the rally may be getting overheated.

Here's how the big four bank stocks have performed over the past six months:

- Australia and New Zealand Banking Group Ltd (ASX: ANZ) shares have gained 15.2%

- National Australia Bank Ltd (ASX: NAB) shares are up 19.0%

- Westpac Banking Corp (ASX: WBC) shares have gained 26.7%

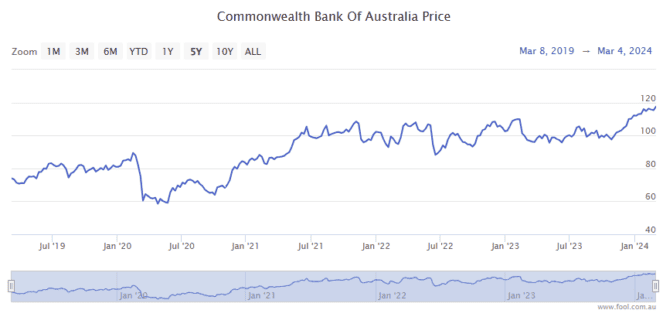

- Commonwealth Bank of Australia (ASX: CBA) shares are up 16.5%

For some context, the ASX 200 has gained 6.4% over this same period.

The blistering rally sees ASX 200 bank shares trading at more than one-year highs. On Monday, the CBA share price notched a fresh all-time high. Australia's biggest bank closed the day at $118.12 a share.

Are ASX 200 bank shares getting frothy?

Concerns that the rally may be running out of steam are being fuelled on several fronts.

First, there's the increasing level of bad debts reported by the ASX 200 bank shares as more customers come under pressure from high interest rates.

The level of non-performing loans hasn't reached critical levels yet. And the banks are well-capitalised to withstand some impairments. But should bad debt levels continue to rise, investors may start to rethink their portfolio holdings.

Second, net interest margins among the banks are coming under pressure amid intense competition in the lucrative Aussie mortgage market. This is crimping profit margins and could also see the ASX 200 bank shares come under selling pressure down the road.

E&P Capital analyst Azib Khan is sceptical on the big share price gains of the last six months, with investor exuberance about pending interest rate cuts potentially sending the bank stocks unjustifiably high.

According to Khan (quoted by The Sydney Morning Herald), "Prospects of interest rate cuts have seen bank share prices get ahead of themselves. While rate cuts may well prove beneficial for bank earnings, [future earnings forecasts] already appear quite optimistic."

Morgan Stanley equity analyst Richard Wiles flagged the historically high forecast price-to-earnings (P/E) ratios the ASX 200 bank shares are trading on as a potential warning sign.

"In our view, the major banks did not deliver the material upgrades to earnings, dividend or buyback expectations necessary to support current multiples," Wiles said.

There you have it.

Proceed with caution.

And, as always, if you're unsure of where or how to invest your money, seek out some professional help.