Certainly there are many different styles of investment out there, and individual investors have their own tastes.

Those that favour dividend shares might look at the outlook for income before deciding to buy an ASX stock. Punters who like ASX growth shares may well be analysing how fast the revenue is growing.

But there is one metric that all investors, regardless of their style and taste, need to pay attention to.

That's according to finance expert and buy-and-hold advocate Brian Feroldi, who cited GoPro Inc (NASDAQ: GPRO) as a classic example.

"Ten years ago, few companies were as 'on fire' as GoPro. Its cameras were wildly popular. Revenue more than doubled over the two years ending in 2014. Net income quadrupled," he said in his newsletter.

"And yet, if you invested $10,000 back then, today's value would be a measly $600."

What happened there?

Everyone loved GoPro, right?

Feroldi described GoPro's fate in one word: moat.

"You hear investors talking about moats — or sustainable competitive advantages — all the time.

"Ask yourself this simple question: If someone gave you $1 billion to create a product to steal market share away from the industry leader, could you do it?"

If the answer is "yes", then that company does not have a reliable moat.

"GoPro failed this test. It faced a slew of copycats — with budgets under $1 billion — and competed directly with the iPhone."

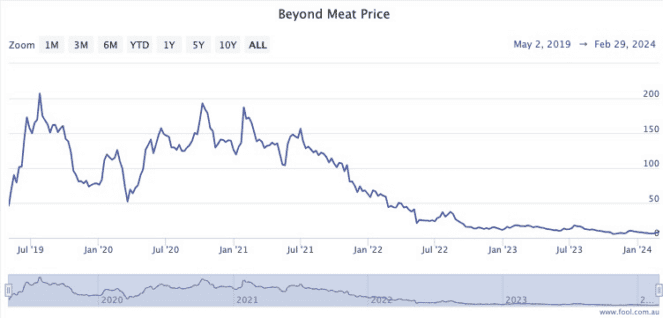

Other US stocks — and there are plenty of ASX examples too — like Fitbit, Beyond Meat Inc (NASDAQ: BYND) and Groupon Inc (NASDAQ: GRPN) all came along in a blaze of glory.

But, as Feroldi, pointed out, over the years they all "destroyed vast amounts of shareholder wealth".

All three stocks, if the investor had asked the moat question above, would have had the clear answer of "yes".

A billion bucks can't make a dent in these businesses

Conversely, if the answer is "no" for a particular company, you know that there is a strong chance a moat exists.

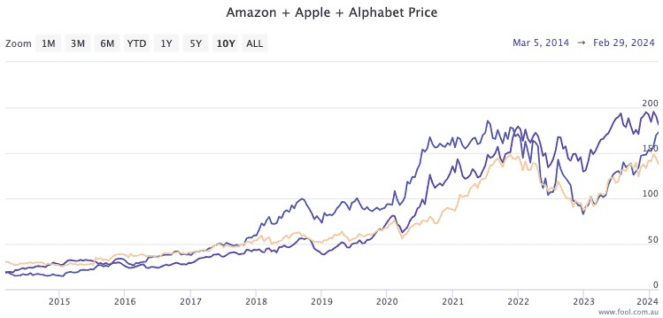

The best performing stocks in the US over the past decade — Amazon.com Inc (NASDAQ: AMZN), Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL) — all easily pass the moat test.

"Amazon — $1 billion wouldn't come close to matching its fulfilment centre network. Apple — a $1 billion budget could build a smartphone, but no one would buy it, even if they sold it at a loss," said Feroldi.

"Google — multiple billions have been invested into Yahoo & Bing for decades, but they still don't have 5% market share combined!"

Interestingly, moats aren't necessarily about a unique technology or product.

"You could create a Coca-Cola Co (NYSE: KO) clone for less than $1 billion. But good luck supplanting the company's brand proposition & distribution."

So next time you consider buying an ASX stock, perform the moat test on it.

And you might even want to try that on the shares you already have in your portfolio.