The ASX energy share AGL Energy Ltd (ASX: AGL) is a leading ASX utilities stock, but there's another one that could be even better, particularly for dividends.

Utility businesses can provide defensive earnings and a decent dividend yield. Households and businesses need energy – what AGL provides is an essential service.

But, some of AGL's profit is dependent on energy prices, which can be unpredictable. Decarbonisation is a big opportunity for many businesses to tap into, but it's complicated for AGL. Its old coal power plants are going to be turned off, cutting off an earnings generator for the company.

AGL needs to invest heavily in renewable energy generation for the transition, which means a lot of capital. There's also the challenge that many households are installing solar panels on the roof. That's reducing some of the demand for AGL's energy.

There's one ASX utilities stock that I think could be a better choice to buy: Duxton Water Ltd (ASX: D2O). It's a business that owns water entitlements and leases them to agricultural operators on a short-term or long-term basis.

Growing dividends

Owners of AGL shares have seen a big decline in the dividend compared to FY19.

Duxton Water paid a dividend per share of 2.3 cents in November 2017, 2.4 cents in April 2018, 2.5 cents per share in September 2018 and so on. It has grown its dividend every six months since 2017. The latest declared half-year dividend was 3.6 cents per share.

The company has guided that it's targeting a half-year dividend payment of 3.7 cents per share next. This means the two dividends to be paid during the 2024 calendar year will amount to 7.3 cents per share, which translates into a grossed-up dividend yield of 7.1%.

Useful tailwinds for the ASX utilities stock

According to Duxton Water, the government has introduced an act to support the recovery of water for the environment until 31 December 2027, while also removing the legislative cap on buybacks so that the government can conduct further entitlement share buybacks over the next four years to fulfil the Murray Darling Basin (MDB) plan's remaining targets.

The government has committed to delivering 450 gigalitres of additional environmental outcomes with the current shortfall of 242 GL.

There's also the growing number of permanent crops, such as almonds, being planted in Australia that have higher water needs. These farms may be willing to pay more for water entitlements.

Good time to buy?

We can look at water as a commodity, which is affected by the supply and demand cycle just like other resources.

When it rains more, there's more water supply and less demand by farmers. When it's dry there is less water supplied and more demand from farmers.

In my mind, it's a good time to invest in this ASX utilities stock during La Nina (wetter periods) and when the dam storage levels are high, because that's when water prices and the Duxton Water share price may be lower. I'd be patient to invest in the middle of El Nino when water prices are higher.

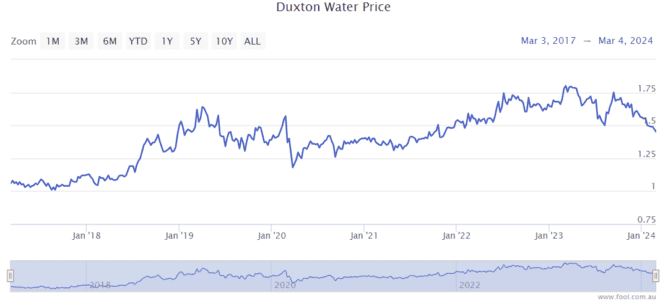

The last few years have been wet, and the dam storages are high. The Duxton Water share price is relatively low right now.

But, La Nina has changed into El Nino.

At the end of January, MDB storages were at 85% capacity. The northern basin storages were at 69%, while southern basin storages were at 88%. At the same time last year, northern and southern basin storages were at 95% and 98% respectively.

If Duxton Water sounds like an interesting investment, I think this could be a good time to look at it, particularly with the prospect of falling interest rates.