Two ASX energy shares are setting the bar high today.

In afternoon trade on Thursday, the All Ordinaries Index (ASX: XAO) is down 0.1%.

But energy stocks Karoon Energy Ltd (ASX: KAR) and Cue Energy Resources Ltd (ASX: CUE) are up 3% and 40% respectively following the release of their half-year earnings results.

Here's what they reported.

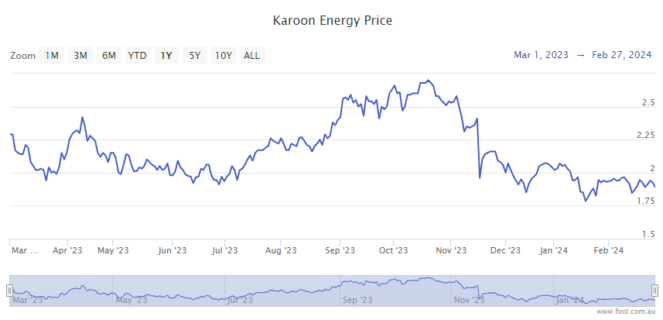

Karoon share price lifts on profit boost

The Karoon share price is marching higher after the ASX energy share reported underlying net profit after tax (NPAT) of US$145 million, up 129% from the prior six months.

The company attributed the boost in profits to higher hydrocarbon sales, improved oil price realisations and lower unit production costs.

Statutory NPAT of US$122.5 million was up 43% from US$85.4 million in the prior half year. This included one-off costs relating to Karoon's Who Dat acquisition, along with hedging and foreign exchange losses.

Sales revenue of US$413 million increased 54.5% from the previous half-year. While underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$283 million increased by 94%.

Karoon held cash and cash equivalents at 31 December of US$170 million.

Commenting on the results lifting the ASX energy share today, CEO Julian Fowles said:

Karoon achieved underlying NPAT of US$144.7 million, which was a record for the company for a six-month period. Baúna Project sales volumes and realised oil prices both increased, up 36% and 13% respectively when compared to the prior six months.

In addition, we received the first contributions from the Who Dat acquisition in the US Gulf of Mexico, albeit for only 11 days.

Which brings us to…

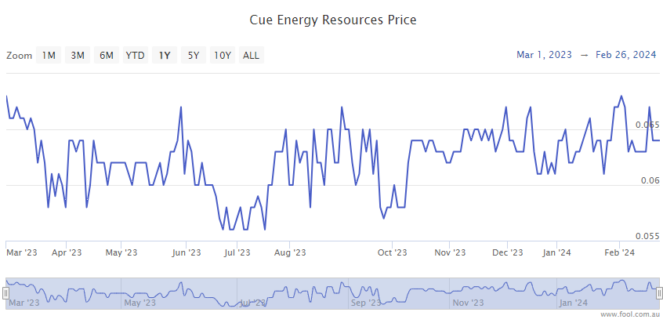

ASX energy share Cue rockets amid special dividend

The Cue Energy share price is shooting out the lights today on the heels of the company's own half-year results (1H FY 2024).

The ASX energy share achieved a 22% year on year increase in six-month revenue to $29 million.

Underlying EBITDAX (which excludes items like exploration costs) came in at $19 million, up 21% from 1H FY 2023.

And NPAT leapt 34% year on year to $9 million.

This saw management declare a 2 cent per share special dividend, which they said was supported by strong cash flow and cash reserves.

Cue had a cash balance of $23 million as at 31 December, up from $15 million at 30 June.

Commenting on the strong results sending the ASX energy share rocketing today, Cue CEO Matthew Boyall said, "We're building on a consistent trend of growth, with revenue increasing more than 200% over the past four years."

Boyall added:

This success is fuelled by several key factors including strong production performance, disciplined reinvestment and an ongoing focus on lowering costs. Our Indonesian assets, particularly the Mahato PSC, were significant contributors, generating $16.4 million in revenue.