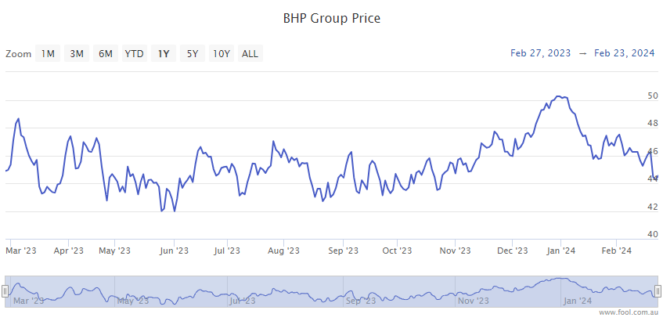

The BHP Group Ltd (ASX: BHP) share price is trailing the S&P/ASX 200 Index (ASX: XJO) today.

Shares in the mining giant are down 0.5% at the time of writing in afternoon trade on Tuesday, more than twice the 0.2% losses posted by the benchmark index at this same time. In earlier trade, BHP stock was down more than 1.2%.

And it's not just the BHP share price dragging on the ASX 200 today.

The Fortescue Metals Group Ltd (ASX: FMG) share price is down 1.0% and Rio Tinto Ltd (ASX: RIO) shares are also down 1.0%.

So, what's going on?

BHP share price hit by slumping iron ore outlook

BHP, alongside rivals Fortescue and Rio Tinto, are under pressure today following a 4% overnight drop in iron ore prices. The industrial metal is trading for just over US$115 per tonne, down from US$140 per tonne at the beginning of 2024.

Iron ore counts as the biggest revenue earner for all three ASX 200 miners.

BHP is listed on several international exchanges atop the ASX. And the iron ore price slide saw the BHP share price tumble by 1.9% on the NYSE overnight.

Much of the recent weakness in the iron ore price stems from falling expectations for a big uptick in demand from China, Australia's top export market for the steel-making metal.

Many analysts had expected steel output in China to rebound following the nation's Lunar New Year holiday period. But the data shows production remains subdued as China's steel-hungry real estate sector continues to struggle.

Commenting on the market dynamics pressuring the BHP share price today, ANZ Group Holdings Ltd (ASX: ANZ) analysts said (quoted by Mining.com), "Inventories of iron ore at major Chinese ports rose. Supply concerns also eased, with a cyclone threatening WA ports now tracking away from the state's iron ore hub."

Also adding to easing supply concerns is Brazilian iron ore giant, Vale. The company reported that its production remains on track despite inclement weather, while it may also look to boost shipments to markets outside of China.