The Nvidia Corp (NASDAQ: NVDA) share price closed last night at US$785.38, up 16.4% after the semiconductor company delivered a cracking quarterly update that included a 769% net income increase.

Say, what? Yep, that isn't a typo.

Following the results, several brokers have laid out their predictions for the Nvidia share price from here.

And one analyst is tipping the stock will get to US$1,400… within just 12 months.

Nvidia share price on fire

Hans Mosesmann, senior research analyst at Rosenblatt Securities, appears to have the highest 12-month target price on Nvidia at the moment.

He thinks the stock can almost double within the next 12 months to US$1,400 per share.

That's a pretty remarkable prediction for a company that already has a market cap of US$1.94 trillion.

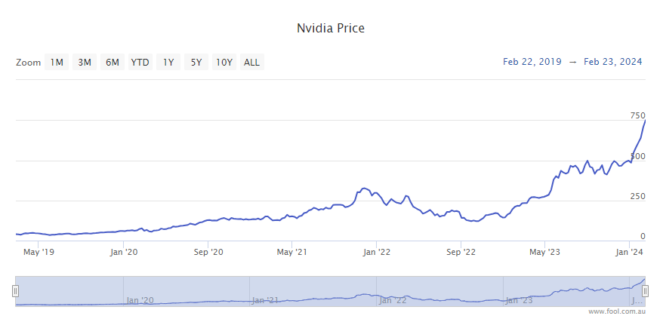

Then again, the Nvidia share price has more than tripled over the past year. So, in a historical context, you could say Mosesmann's tip of a near-doubling over the next year sounds like a slowdown!

For the record, this time last year the Nvidia share price was about US$232.

That's pretty staggering growth.

What else is staggering is Nvidia's results for 4Q FY23 and the full year reported yesterday.

Let's recap.

Astonishing 4Q FY23 results send Nvidia shares 16% higher

For the three months ended 31 December, Nvidia reported:

- Revenue up 265% year over year to US$22.1 billion

- Gross margin up 12.7% to 76%

- Net income up 769% to US$12.3 billion

- Earnings per share (EPS) up 765% to US$4.93

For the full year 2023, Nvidia reported:

- Full-year revenue up 126% to a record of US$60.9 billion

- Gross margin up 15.8% to 72.7%

- Net income up 581% to US$29.76 billion

- Earnings per share up 586% to US$11.93

Nvidia's founder and CEO, Jensen Huang, commented: "Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations."

The company expects 1Q FY24 revenue to go higher still, to $24 billion (+/- 2%), with an improved gross margin in the range of 76.3% to 77%.

And all of this good news has market analysts in a bit of a lather.

Most brokers raise 12-month share price targets

Most brokers raised their 12-month price targets on Nvidia overnight and maintained their buy ratings.

Here is a selection of the most bullish predictions:

- Rosenblatt Securities raised its price target to US$1,400, up from US$1,100 (maintain buy)

- Keybanc raised its Nvidia share price target to US$1,100, up from US$740 (maintain overweight)

- Benchmark raised its price target to US$1,000, up from US$625 (maintain buy)

- Bernstein raised its price target to US$1,000, up from US$700 (maintain outperform)

- Bank of America raised its price target to US$925, up from US$800 (maintain buy)

- Truist raised its price target to US$911, up from US$691 (maintain buy)

- TD Cowen its Nvidia share price target to US$900, up from US$700 (maintain outperform)

- Wolfe raised its price target to US$900, up from US$630 (maintain outperform)

A couple of brokers were a little more conservative on Nvidia's share price trajectory from here:

- UBS lowered its price target to $800, down from $850 (maintain buy)

- Deutsche Bank raised its price target to $720, up from $560 (maintain hold rating)

- Morgan Stanley raised its price target to $795, up from $750 (maintain overweight)

Nvidia's place in the world

As my colleague Seb points out, Nvidia's market cap is larger than many countries' entire economies.

However, Nvidia still isn't as big as Microsoft Corp (US$3 trillion) and Apple Inc (US$2.82 trillion).

Globally, Nvidia is the world's fourth-most valuable listed stock.