The Fortescue Ltd (ASX: FMG) share price is up by 1% after the ASX mining share reported its FY24 first-half result.

Fortescue share price rises on strong result

- Revenue increased by 21% to US$9.5 billion

- Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) grew by 36% to US$5.9 billion

- Net profit after tax (NPAT) grew 41% to US$3.3 billion

- Free cash flow increased 68% to US$2.66 billion

- Net debt improved 45% to $569 million

- Interim dividend increased by 44% to A$1.08 per share

Fortescue's profitability soared after the average revenue it achieved rose by 24% to US$108.19 per dry metric tonne (dmt). The production (C1) costs only rose by 2% to US17.77 per wet metric tonne. It sold 95.2mt of ore, which was a 2% reduction compared to the prior corresponding period.

The ASX iron ore share said it has had a strong focus on productivity and efficiency

What else happened in the FY24 first half?

Iron Bridge, a high-grade project that Fortescue had been working on for a long time, achieved its first shipment of high-grade magnetite concentrate in September 2023.

The Fortescue share price could be heavily influenced by the success (or failure) of the green energy division which is looking to produce green hydrogen. In the last several months, the company has announced a final investment decision on the Phoenix hydrogen hub in the US, the Gladstone PEM50 project in the US and a green iron trial commercial plant in the Pilbara. The EU awarded Fortescue's Holmanset project a grant of €204 million.

The company also launched Fortescue Capital, which is a green energy investment accelerator, headquartered in New York City.

What did Fortescue management say?

The Fortescue Metals CEO Dino Otranto said:

Fortescue's performance in the first half of FY24 has been excellent, with the team achieving our second highest first half shipments while maintaining our strong focus on safety and keeping our costs low.

Whether it's through our first green energy projects, our diversification into the high grade segment of the iron ore market through Iron Bridge, or expansion of our global footprint with the Belinga Iron Ore Project in Gabon, we remain committed to creating value for all our stakeholders.

What's next for Fortescue?

The company is making ongoing decarbonisation progress, including ongoing construction of a 100MW solar farm and testing of the first battery electric haul truck prototype in the Pilbara.

Work is underway at Iron Bridge to replace the high-pressure section (65km) of the Canning Basin raw water pipeline to de-risk and improve the performance. The installation is scheduled to be completed by mid-2025 and isn't expected to impact Iron Bridge's ramp-up. This comes with an estimated cost for Fortescue of US$100 million, with most of that cost coming in FY25.

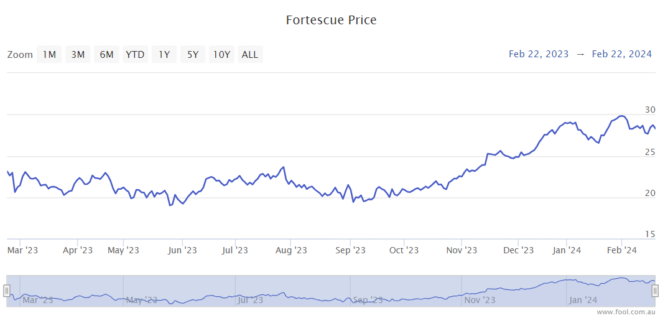

Fortescue share price snapshot

In the past six months, the Fortescue share price has risen by 34%, compared to a rise of just 7% for the S&P/ASX 200 Index (ASX: XJO).