Artificial intelligence (AI) is a rapidly developing technology with the potential to change the world if utilised correctly. A leading fund manager has picked out an S&P/ASX 200 Index (ASX: XJO) share that could be a major winner from AI: Megaport Ltd (ASX: MP1).

Of course, no company is guaranteed to do well just because it has a connection to AI. For example, telco companies didn't necessarily win significantly from the introduction of the Internet. Instead, the big gains went to names like Amazon.com and Meta Platforms that developed platforms like Facebook and Instagram.

Megaport is not a telco. It's an "enterprise software and services organisation that enables data connection between companies and data centres", according to fund manager Wilson Asset Management.

The ASX 200 share is primed for growth

The fund manager noted that the Megaport share price has been rising after its quarterly earnings update beat market expectations. The ASX 200 share announced it had won a large US-based healthcare customer worth $4.2 million over the next three years, its largest deal to date.

WAM then said:

Megaport is a beneficiary of an increase in data connectivity and artificial intelligence and we believe the company is well-positioned to continue taking advantage of the demand for its services over the next few years.

How fast is it growing?

In the quarterly update for the three months to December 2023, Megaport advised its total revenue was $48.6 million — 5% higher than the FY24 first quarter. When you annualise that growth, it's solid growth.

Profitability is now accelerating, even though the business is investing hard for growth.

Its earnings before interest, tax, depreciation and amortisation (EBITDA) was $12.7 million, up $10.3 million, or 429%, compared to the second quarter of FY23.

The ASX 200 share's net operating cash flow was an inflow of $15.2 million for the FY24 second quarter, an increase of $4.5 million (or 42%) quarter over quarter and an increase of $15 million compared to the second quarter of FY23.

With revenue growth and even faster profit growth, it's looking good for the company and shareholders.

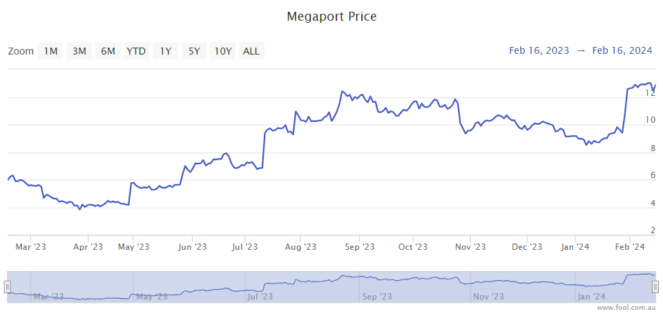

Megaport share price snapshot

Over the past year, the Megaport share price has risen by more than 110%.