S&P/ASX 200 Index (ASX: XJO) energy stock Ampol Ltd (ASX: ALD) is charging higher today.

Shares in the petroleum refiner and fuel distributor closed Friday trading for $37.59. In morning trade on Monday, shares are swapping hands for $38.03 apiece, up 1.17%.

For some context, the ASX 200 is up 0.2% at this same time.

This outperformance comes following the release of Ampol's full-year 2023 results.

Here's what Ampol reported.

ASX 200 energy stock gains amid earnings boost

- Earnings before interest and tax (EBIT) – excluding significant items – came in at $1.30 billion, up 2% on 2022

- Statutory net profit after tax (NPAT) of $549 million, down 25% year on year

- Net borrowings as at 31 December of $2.20 billion, down from $2.46 billion a year earlier, with leverage at 1.6 times and committed facilities of $5.0 billion

- Final fully franked dividend of $1.20 per share plus special dividend of 60 cents per share for a record final payout of $1.80 per share, up 16% from 2022

What else happened with Ampol during the year?

The growth in 2023 earnings that looks to be helping the ASX 200 energy stock outperform today was spurred by earnings growth in Ampol's non-refining divisions, along with a full 12 months' contribution from Z Energy.

Ampol acquired Z Energy in mid-2022, and the company reported it has so far delivered on the expected acquisition benefits and synergies. In 2023, Z Energy contributed EBIT of $264 million to group earnings.

2023 saw Ampol achieve record total sales volumes of 28.4 billion litres, up 17% year on year.

And passive income investors will be pleased with the all-time high, fully franked final dividend payout of $1.80 per share.

That takes the dividend payments for 2023 to $2.75 per share for a total payout of $655 million. This comes in at 89% of NPAT, at the top of Ampol's payout range for the full year.

What did management say?

Commenting on the results that are seeing the ASX 200 energy stock outperform today, CEO Matt Halliday said:

The result reinforces the adaptability and resilience of Ampol's integrated supply chain in what was another year where energy markets moved rapidly in response to geopolitical events. We continued to grow our Petrol and Convenience earnings, delivering another strong performance in Convenience Retail…

The balance sheet is strong, providing Ampol with the flexibility to invest in our core fuels and convenience businesses, and to prudently invest in the energy transition while delivering our highest ever dividends to shareholders.

What's next for Ampol?

Looking to what could impact the ASX 200 energy stock in the months ahead, Ampol plans to upgrade its Lytton refinery to produce gasoline compliant with the government's new fuel specifications for both regular and premium gasoline grades.

Ampol is also continuing to extend its charging network for EVs. The company expects this to extend to 300 charging bays in Australia and 150 charging bays in New Zealand by the end of 2024.

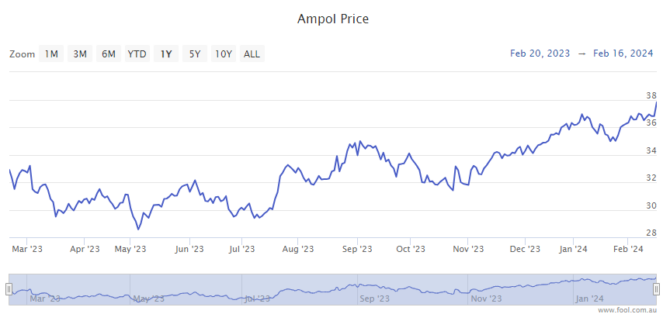

How has this ASX 200 energy stock been tracking?

The Ampol share price is up 18% in 12 months. And that's not including the $2.75 a share in dividends the ASX 200 energy stock delivered over the year.