If it's passive income you're looking for, then you'll want to have a look at this S&P/ASX 200 Index (ASX: XJO) dividend star.

Namely diversified ASX 200 financial stock Macquarie Group Ltd (ASX: MQG).

Macquarie was founded in 1969, and the company began trading on the ASX in November 2007.

When it comes to passive income, Macquarie has a very reliable track record. The company has paid out two partly franked dividends every year since 2013.

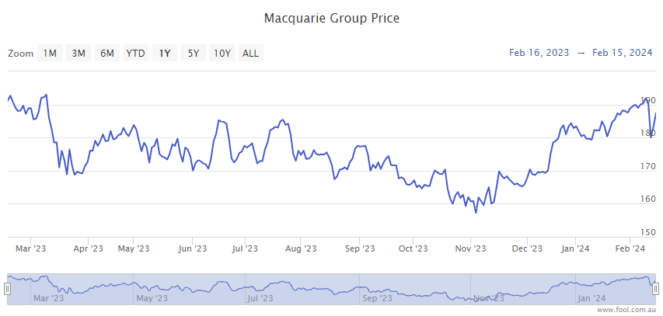

Atop its juicy dividends, the Macquarie share price has also been on a strong upward trend over the past three months.

As you can see in the chart below, since 13 November, the ASX 200 financial stock has gained 21%.

So, alongside the passive income I'm aiming to bank for this ASX dividend star, I'll also be aiming to see some further share price gains to sweeten the pot.

Tapping this ASX dividend star for a $380 monthly passive income

Before running through the maths, take note that the yields you generally see quoted are trailing yields. Future yields may be higher or lower depending on a range of company-specific and macroeconomic factors.

With that said, Macquarie paid a final dividend of $4.50 a share on 4 July. The interim dividend of $2.55 a share will have landed in eligible investors' bank accounts on 19 December.

That equates to a full year's passive income payout of $7.05 a share.

At Friday's closing price of $192.50 a share, this ASX 200 dividend star trades on a trailing yield of 3.7%, 40% franked.

Now let's run the maths.

If I'm aiming for $380 a month in passive income (or a tidy $4,560 a year), I'd need to buy 608 Macquarie shares today.

And, as mentioned up top, I'll be hoping to supercharge those returns if the Macquarie share price keeps marching higher.