The ASX All Ords is slightly higher on Tuesday as earnings season rolls on and some stocks take a beating.

Cases in point today: Seven West Media Ltd (ASX: SWM) and James Hardie Industries plc (ASX: JHX).

The Seven West Media share price is currently down a whopping 10.91% at 24.5 cents after the group released its 1H FY24 earnings.

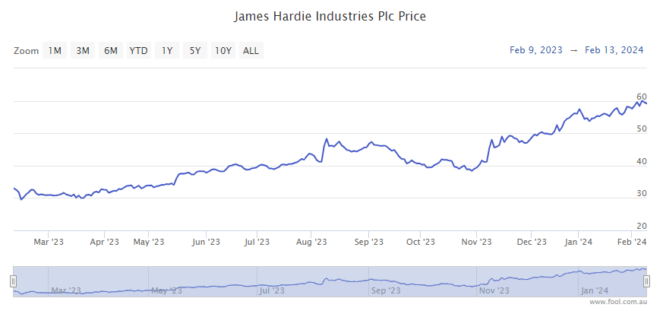

Building materials supplier James Hardie is also down, with the share price 5.41% lower at $55.99. The company released its 3Q FY23 update today.

Let's find out why these ASX All Ords stocks are taking a tumble.

What's killing this ASX All Ords media player?

Seven West Media said it was successfully executing its plan to grow audience and revenue share, however, weaker advertising sales in 1H FY24 led to a 40% collapse in its earnings before interest, taxes, depreciation, and amortisation (EBITDA) to $124 million.

The ASX All Ords media company reported group revenue of $775 million, down 5% on the previous corresponding period (pcp).

Underlying net profit after tax (NPAT) (excluding significant items) came in at $63 million, down 49% pcp.

SWM CEO James Warburton said:

SWM successfully executed on our strategy during the period to deliver consistent and engaging content to drive audience growth and revenue share across the total TV market.

Despite this progress and our disciplined management of costs, our financial performance reflects the weakness in advertising markets, particularly as the second quarter progressed.

We continue to believe in the power of television and firmly believe that the total TV industry is set to regain market share. Total TV is now growing, and Seven is leading that growth.

The ASX All Ords media stock has fallen 45.6% over the past 12 months.

Investors hit the sell button on ASX All Ords building stock

ASX All Ords building materials supplier, James Hardie has also disappointed investors today.

This is despite the company reporting growth in the third quarter of FY23 on all financial metrics.

The company reported global net sales of US$978.3 million in 3Q FY24, up 14% on the pcp of 3Q FY23.

Adjusted EBITDA came in at US$280.4 million, up 34%. The adjusted EBITDA margin was 28.7%, up 4.4%.

James Hardie CEO Aaron Erter said the company had delivered four strong consecutive quarters demonstrating rising market share.

We have a superior value proposition that helps our customers grow and be successful.

Our team is focused on maintaining this momentum and consistency to deliver strong financial results again in the fourth quarter.

The ASX All Ords building materials stock has lifted 76.7% over the past 12 months.