We'd all like to live a comfortable life in retirement, and we may need our assets to last a number of decades. I'm going to tell you why I think a couple of leading ASX-listed exchange-traded funds (ETFs) could be the right choice for retirees.

I'd guess plenty of retirees have money invested in property, ASX bank shares and even a small number of high-risk, high-return mining and energy shares. There are a lot of other businesses that could deliver better returns and give diversification.

I'm not suggesting people need to become full-time fund managers. Instead, ASX ETFs – which give us exposure to a group of companies in a single investment – could be the answer. Plenty of them are invested in international businesses too, giving exposure away from Australia.

Imagine having ETF investments worth $100,000. If they go up 10% over a year, the end result would be $110,000. Selling $5,000 would equate to a yield of 5% on the starting balance, and the investor would be left with $105,000. Of course, with the share market, we might see an 18% rise in one year and a 10% fall the next year – we can't know what's going to happen in the next 12 months.

The lower the 'yield' we take, the more sustainable it is likely to be when the bad years are included over a longer time period. If an ETF goes up 15% in one year, I would not bet on it rising another 15% in the next year. That's why I'd look at something like 4% to up to perhaps 6% as the target withdrawal yield.

Here are two ASX ETFs that I think would work well in retirement.

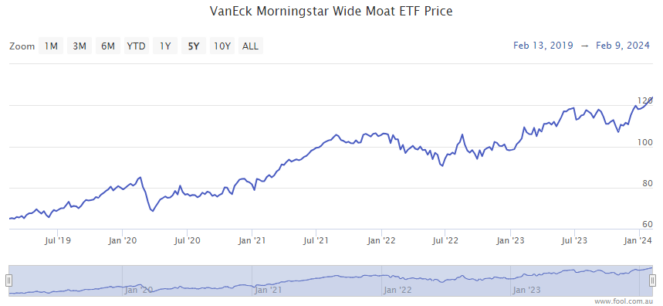

Vaneck Morningstar Wide Moat ETF (ASX: MOAT)

This fund invests in (US-listed) businesses that have very strong competitive advantages, or economic moats, which give them the ability to outperform their peers. There are a number of different moats, including brand power, patents, licences, cost advantages, network effects, switching costs (for customers) and more.

The MOAT ETF specifically looks for companies that Morningstar analysts think have economic moats that will endure for 10 to 20 years.

Once it establishes a watchlist of these advantaged companies, the ASX ETF will invest only if a company is trading at a valuation cheaper than what the analysts think is a fair price.

Since this fund's inception in June 2015, it has returned an average of 15.5% per annum.

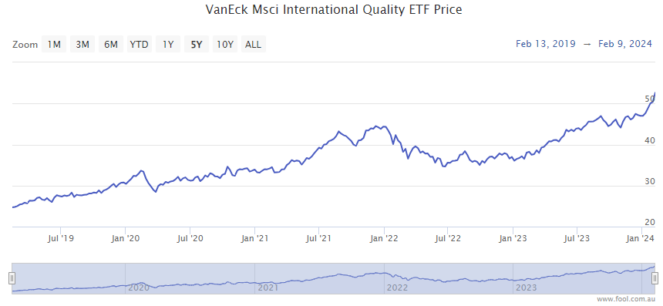

VanEck MSCI International Quality ETF (ASX: QUAL)

This fund is invested in 300 companies from across the globe. To qualify for this portfolio, companies have to rank well on three things – earnings stability, a high return on equity (ROE), and low financial leverage.

In other words, it suggests they make high profits for how much shareholder money is retained in the business, they don't typically see large, negative earnings shocks, and they have strong balance sheets.

When you put these factors together, the ASX ETF is typically going to invest in companies that do very well over time.

At the moment, the biggest positions are names like Nvidia, Microsoft, Meta Platforms and Apple.

300 businesses in a single investment is a lot of diversification, but it hasn't dampened the returns. Since its inception in October 2014, the QUAL ETF has returned an average of 16.7% per annum.

Foolish takeaway

Share markets have performed strongly over the last 14 months – this recovery has shown why it's a good idea to invest when there's fear around.

I wouldn't expect the next 12 months to show huge returns, but I think both of these ASX ETFs are capable of producing very good returns over the next three to five years and the longer term.