There are a number of S&P/ASX 200 Index (ASX: XJO) stocks that have handed investors outsized gains so far in 2024.

But one company is racing ahead of the pack.

Any guesses?

If you said ASX 200 tech stock Megaport Ltd (ASX: MP1) give yourself a virtual gold star.

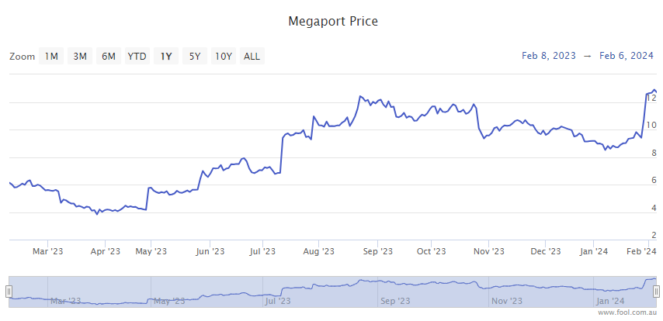

Despite slipping 1.1% in afternoon trade today, the Megaport share price is up a whopping 39.3% since the opening bell kicked off trading for 2024 on 2 January. That sees the ASX 200 tech stock up more than 106% over the past 12 months.

For some context, the ASX 200 is up 0.4% year to date, and up just under 2% over the past full year.

Megaport, if you're not familiar, provides Network as a Service (NaaS) solutions. The company's software network helps businesses quickly connect their network to services through its portal.

Here's what's been driving investor interest in the ASX 200 stock.

Why are investors bidding up this ASX 200 stock?

Among the ongoing tailwinds for the Megaport share is the rapid global growth in data centres.

The company recently rolled out a new platform called Megaport Reach, which it says enables customers to "connect to over 1,000 clouds/service providers/data centres in less than 60 seconds".

And business has been booming.

The ASX 200 stock closed up an eye-popping 27.6% on 30 January following the release of the company's quarterly update for the three months ending 31 December.

Among the highlights, Megaport reported total quarterly revenue of $48.6 million. That was up an impressive 31% year on year, spurred by ongoing growth in customers and services across all its operational regions.

Megaport reported earnings before interest, taxes, depreciation and amortisation (EBITDA) of $15.1 million for the quarter.

And the company's positive net cash flow of $6.9 million increased by 23% from the prior quarter. Megaport's cash balance grew by $7.3 million over the three months to $62.5 million, as at 31 December.

And management said these figures would have been higher yet, if not for a significant negative foreign exchange impact amid a stronger Aussie dollar.

Despite the strong 2024 performance from this ASX 200 stock, Goldman Sachs forecasts more gains to come.

The broker has a buy rating on the stock with a $13.50 price target on Megaport shares.

That represents a potential 5.5% further upside from the current $12.80 per share Megaport is trading at currently.