Do you want to triple your money in six years?

Who doesn't, right?

While no one can make any guarantees, every investor can, after careful research, make some educated buys to attempt this goal.

My favoured method of reaping such spectacular gains would be through ASX growth stocks.

I think they have more potential for big gains — at a higher risk — than, say, dividend stocks, which might be better for nerves.

Here are two ASX growth shares that currently have the potential to turn your $10,000 into $30,000 by the start of the next decade:

The growth stock that heals the world

Avita Medical Inc (ASX: AVH) is a biotechnology company founded by 2005 Australian of The Year Dr Fiona Wood.

The company's flagship product is a spray-on skin for burns patients.

Like most stocks in that industry, Avita shares have swung wildly up and down over the years.

However, enough has gone right in recent times to push the stock 292% upwards since June 2022.

Even going back five years, the Avita share price has doubled.

The compound annual growth rate (CAGR) over the past 20 months is well over 100%, and the five-year rate is just under 15%.

To grow $10,000 to $30,000 by 2030, your investment needs to expand at around 20% per annum.

Remembering past performance is no indicator of the future, a replication of Avita's recent history could easily take investors to our end-of-decade target.

Professional investors are convinced Avita shares will make a decent run-up, with CMC Invest showing nine out of 10 analysts rating it as a buy.

I want my Jimmy Choos, regardless of inflation

Cettire Ltd (ASX: CTT) is an online retail platform for selling luxury goods.

Apparently the economic downturn in the west and in China over the past two years hasn't dented the global demand for expensive fashion.

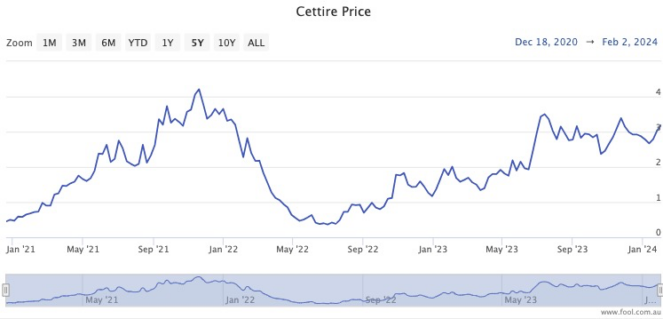

Again, like Avita Medical, this growth stock has definitely had massive peaks and troughs.

However, since listing in December 2020, overall the result is that Cettire shares are now trading 529% higher.

That's an impressive CAGR of 79%.

Even as the business matures, making 20% a year until 2030 is not out of the question.

Three of four analysts believe Cettire shares are a buy right now, according to CMC Invest.