The Janison Education Group Ltd (ASX: JAN) share price is shooting out the lights today.

Shares in the ASX education technology company closed yesterday's session at 25.5 cents. At the time of writing on Tuesday morning, shares are swapping hands for 37 cents apiece, up a whopping 42.31%.

In earlier trade today, Janison Education shares reached as high as 42 cents each before a partial retreat.

For some context, the All Ordinaries Index (ASX: XAO) is down 0.71% at this same time.

Here's what's spurring ASX investor interest today.

What did the education technology company announce?

The Janison Education share price is soaring after the company reported it has signed an agreement with the New South Wales Department of Education and Cambridge University Press & Assessment.

The agreement will see Janison deliver New South Wales's selective education placement tests as computer-based tests via its digital assessment platform.

More than 30,000 students a year will take the computer-based tests for NSW's Selective High School and Opportunity Class Placement Tests, commencing in 2025. Janison will provide services, including the placement tests, the computer-based test platform, managing the test centres, and supervision.

Commenting on the agreement sending the Janison Education share price rocketing today, founder and interim managing director Wayne Houlden said, "Janison is delighted to have been selected by the department to host the placement tests and support the digital transformation of testing in NSW."

He added that the new five-year agreement "extends the 20-plus years relationship that Janison and the department have worked together".

The company notes that this is the largest contract signed in its history.

Management expects the agreement to generate revenue of up to $45 million over the initial five-year term, provided all stages are approved. There's also an option for the NSW Department of Education to extend the agreement for another five years.

The company intends to start work on the new platform and services early in 2024. Pilots of the new platform are expected to be completed in 2024, with a full rollout of the digital assessment platform completed in 2025.

Janison Education share price snapshot

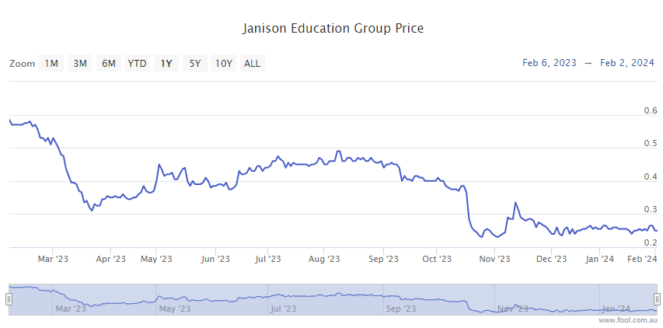

With today's big boost, the Janison Education share price is up around 45% in 2024. Shares remain down by around 35% over 12 months.