Have you got $20,000 saved up that you could invest?

Many of you reading this will, because comparison site Finder last year found the average Australian has double that amount saved in their bank account.

ASX shares can turn that into a nice passive income that could pay you thousands of dollars each month in return for no labour.

Curious? Read on.

Growth vs dividend

Hypothetically let's construct that $20,000 into a well diversified stock portfolio.

The first step is to do your best to not take any money out of the investment and let it grow. If anything, you should be adding to the nest egg as much as you can.

Does this growth phase call for ASX growth shares, or can it be implemented with a bunch of dividend stocks?

Honestly, it doesn't matter.

As long as you have done the research to satisfy yourself that the stocks will return a satisfactory compound annual growth rate (CAGR) over the long term, go for whatever you want.

Because both capital growth and dividend income contribute towards yearly growth if the latter is immediately reinvested.

How much could I gain each year?

So what kind of performance is realistic in the long run?

Let's check out some examples.

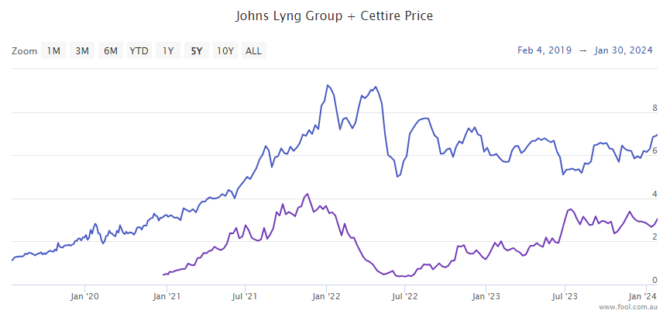

Johns Lyng Group Ltd (ASX: JLG) and Cettire Ltd (ASX: CTT) are two growth stocks that have done pretty well in recent years, and experts reckon have a bright future.

The past has nothing to do with what might happen in the future, but let's analyse their track record for the purposes of working out realistic return expectations.

Over the past five years, Johns Lyng shares have returned an amazing 524%. In just a tick over three years on the ASX, Cettire has gained 521%.

Even if we conservatively assume Cettire has been around for five years, it equates to a CAGR of about 44%.

Over in dividend land, Woodside Energy Group Ltd (ASX: WDS) and Growthpoint Properties Australia Ltd (ASX: GOZ) are pumping out excellent income.

The former is handing out a stunning 10.5% fully franked dividend yield, while the latter is paying 8.4% unfranked.

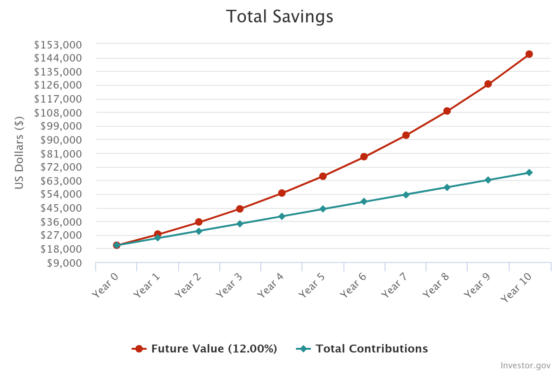

With these types of stocks, I think it's not outrageous to imagine your portfolio could average out to 12% CAGR in the long run.

Ten years for the good times to roll

Going back to that $20,000 portfolio you constructed, let's say you can afford to add $400 a month to the pot.

Let that brew with 12% CAGR, and after 10 years, it will have grown to $146,350.

From the 11th year, instead of reinvesting the returns, try cashing it in.

That will be $17,562 of passive income annually, on average.

This means $1,463 of cash landing in your bank account each month for the rest of your life.

That's one way you can turn $20,000 into thousands of dollars of regular extra income.