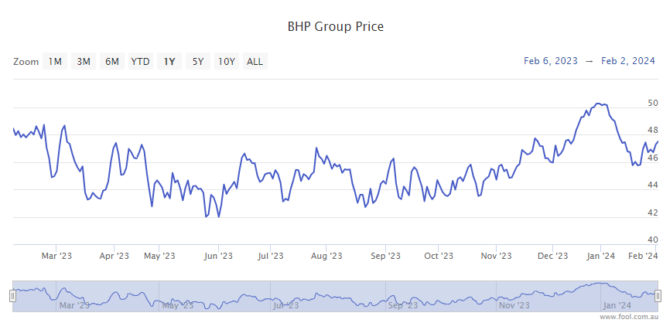

The BHP Group Ltd (ASX: BHP) share price is kicking off the new week with a whimper.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed up 1.1% on Friday at $47.61. In morning trade on Monday, shares are swapping hands for $46.58, down 2.2%.

For some context, the ASX 200 is down 1.2% at this same time.

But it's not just the BHP share price that's underperforming the benchmark today.

The Rio Tinto Ltd (ASX: RIO) share price is down 1.9% while Fortescue Metals Group Ltd (ASX: FMG) shares are down 2.3% at this same time.

Here's what's going on.

Why is the BHP share price trailing the ASX 200 on Monday?

The BHP share price looks to be catching some headwinds from a retrace in the iron ore price.

Iron ore counts as the ASX 200 miner's top revenue earner, with copper coming in at number two.

Likely fuelled by resurgent concerns over the health of China's economy, the iron ore price turned lower again over the weekend, down 4.1% to US$125.60 per tonne. That sees the iron ore price down more than 20% since 4 January, when the critical steel-making metal was trading for just over US$145 per tonne.

Copper prices also edged lower over the weekend. The copper price is now down 1.5% since 31 January.

And don't forget that BHP is listed on several international exchanges, with its Aussie shares often impacted by the prior day's moves in US markets.

The BHP share price closed down 1.4% on the New York Stock Exchange (NYSE) on Friday.

Now what?

ASX 200 investors tend to be quick to buoy the BHP share price on any increase in the iron ore price and just as quick to sell shares when the industrial metal slides.

But I believe that type of kneejerk reaction is often a mistake in the investing world, where investors can do better by keeping their eyes on the horizon.

There are various forecasts as to what we can expect for the iron ore price in the months ahead, with most analyst having recently upped their price targets.

News of China's slumping stock markets may have some traders spooked about iron ore demand from the world's number two economy. But the Chinese government has been increasing its stimulus measures to support the economy.

And with this increased stimulus in mind, Citi last week forecast that iron ore is likely to reach US$150 per tonne over the next three months amid a recovery in China's struggling, steel-hungry property markets.

If that forecast proves out, it should offer some heady tailwinds for the BHP share price.