Regular readers know that ASX lithium shares have been an absolute bin fire the past 12 months.

Western consumers discouraged by rising interest rates and a Chinese economy already in strife have combined to dampen demand, so the price for the commodity has nosedived.

Just 14 months ago, the lithium carbonate price was touching the 600,000CNY per tonne mark.

Now it can't even make six figures.

But for those who are doubting the ability for the battery material to make a roaring comeback in the future, you just need to take a look at recent history.

Because lithium, like most other minerals, can make unsuspecting investors look silly with a furious turnaround in the supply and demand equation.

$20,000 into $470,000? Yes, please

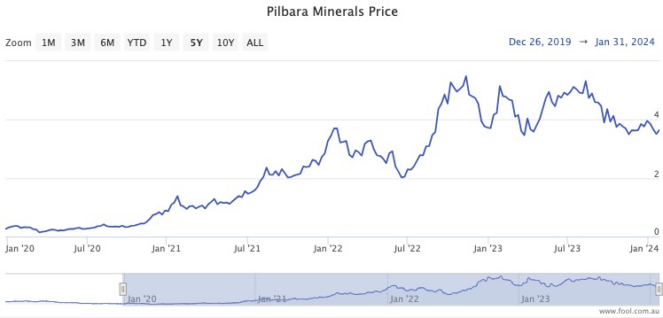

Let's take a look at lithium miner Pilbara Minerals Ltd (ASX: PLS) as an example.

Just under four years ago, in March 2020, Pilbara Minerals shares were going for 15 cents each.

Sure, COVID-19 had just struck the world and no one knew whether we'd be stuck at home for years.

But the rise of electric cars was already well under way, so it is not inconceivable that you could have put $20,000 towards buying Pilbara shares.

Such foresight would have paid off handsomely.

Pilbara Minerals shares closed Wednesday at $3.55, which means that $20,000 has now turned into an incredible $473,333.

What Pilbara Minerals shares teach us

There are two morals from this story.

First is that resource prices can turn around extremely quickly. A stock that seems hopelessly down and out can rocket in just a few weeks, and vice versa.

Second is that your portfolio need not be packed with winners for you to enjoy positive returns overall.

In fact, it is unrealistic to expect you will have a 100% success rate, or even 70%.

For most investors, a handful of multi-baggers will carry the load for the rest of the portfolio.

Good luck out there.