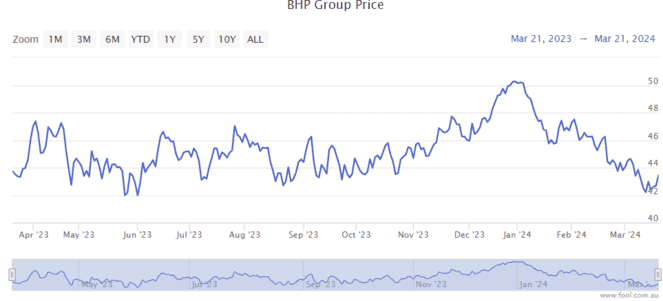

BHP Group Ltd (ASX: BHP) shares have drifted lower this year, as we can see on the chart below.

But what's the outlook for the profit potential of the business?

Commodity prices can have a big impact on the profitability of a mining company. We don't know what resource prices are going to do next week, next month, or next year, so we can look at forecasts as a best guess. But, keep in mind that estimates can change.

FY24

We're more than halfway through the 2024 financial year, and we recently saw the HY24 result.

However, the 2024 full-year profit is still to be determined.

The broker UBS' latest estimate suggested that BHP could generate a net profit after tax (NPAT) of US$13.5 billion in FY24, earnings per share (EPS) of US2.66, and pay an annual dividend per share of US$1.47.

UBS said it's seeing a risk of the iron ore and Escondida falling short of production guidance in FY24, with a meaningful lift needed in the second half to meet the mid-point of the guidance.

If the iron ore price stays at around US$100 per tonne then the business won't be as profitable as it could have been, if the iron ore price had remained above US$120 per tonne.

FY25

In FY25, the company is expected by UBS to generate a net profit of US$13.9 billion, which would be a slight increase compared to FY24. The projected EPS could come to US$2.74 in FY25, an increase of 3%.

UBS is also currently expecting a larger dividend per share of US$1.64 from the business, which would be a rise of 11.6%.

FY26

BHP is expected to see a profit decline in FY26 compared to FY25 (and FY24), with potential profit generation of US$12.1 billion. If that happened, the EPS could fall to US$2.38.

UBS has pencilled a dividend per share of US$1.43 in FY26, which would be lower than both FY25 and FY24.

Is this the right time to buy BHP shares?

With a cyclical business like this ASX mining share, I think the right time to buy is when there's a weakness with the commodity.

The iron ore price (and nickel price) has plunged from above US$140 per tonne, so I think it's much more appealing to buy BHP shares during this weaker period.

It's not as cheap as it could be, but I'm a bit more confident at this lower price. However, it should be said that miners aren't likely to be consistent ASX dividend shares.