As we head into the second month of 2024, now could be a good time to look at adding some top ASX blue-chip stocks to your investment portfolio.

These companies have generally been around for many years, providing investors with a lengthy track record to review. They also tend to offer relatively stable long-term growth, compared to their small-cap peers.

And, thanks in part to their weighty market caps, ASX blue-chip stocks are often able to secure cheaper financing than lesser-known companies.

With that said, here are three ASX blue-chip stocks I think every Aussie investor should own.

ASX blue-chip bank stock

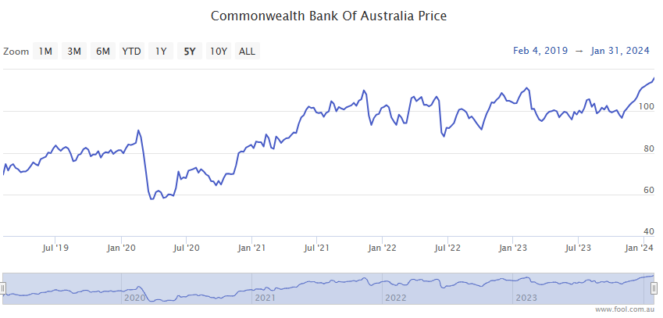

First up we have S&P/ASX 200 Index (ASX: XJO) bank stock Commonwealth Bank of Australia (ASX: CBA).

With a market cap of $191 billion, CBA is Australia's largest bank and the second-biggest company listed on the ASX. CBA offers a range of integrated financial services, which is the kind of diversity I like to see with an ASX blue-chip stock.

The bank has been taking steps to retain its dominance in the lucrative Aussie mortgage markets. And it is well-placed to weather any financial shocks or economic slowdown, with a common equity tier 1 (CET1) ratio of 11.8%.

CBA shares are up 4% over the past 12 months and have really lifted off since November. The bank stock is up 18% since the closing bell on 31 October.

The ASX blue-chip stock also paid $4.50 in fully franked dividends over the last 12 months. At the current share price, that sees CBA trading at a trailing yield of 3.9%.

Which brings us to…

The biggest stock on the ASX

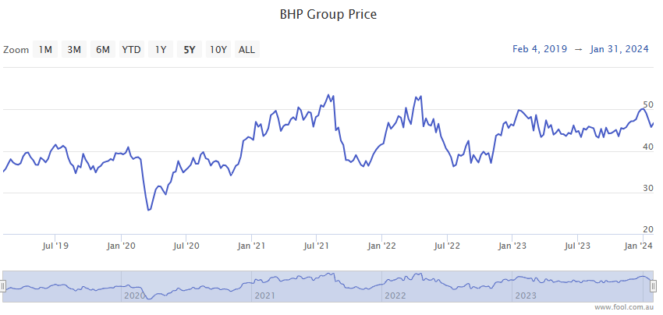

ASX 200 iron ore giant BHP Group Ltd (ASX: BHP) is the biggest company listed on the ASX. The ASX blue-chip stock has high-quality mining assets in Australia, North America, and South America.

Atop that geographic diversity, BHP's revenue, while weighted towards iron ore, also comes from copper, coal, nickel, and uranium, among others.

BHP's profits, share price growth, and the dividends it pays out are hinged on the price of the elements it digs from the ground. So you should expect a bit more volatility from this stock.

But longer term, global demand for its products should remain strong and is almost certain to grow. And the ASX blue-chip stock is well-positioned to continue delivering its supplies at the lower end of the cost curve.

Over the past 12 months, the BHP share price is down 3%. Shares are up 9% since 23 October.

BHP shares trade on a 5.5% fully franked dividend yield.

Rounding out the list of three ASX blue-chip stocks I think every Aussie investor should own is…

ASX blue-chip healthcare stock

CSL Ltd (ASX: CSL) counts among the world's top biotechnology companies. Its segments include CSL Behring, CSL Vifor, and its Seqirus businesses.

The ASX blue-chip stock is the world's biggest in the $38 billion plasma protein therapies industry and the second biggest in the $7 billion flu vaccines industry.

CSL is the third largest company listed on the ASX with some strong growth prospects ahead. In fact, management is forecasting annual double-digit earnings growth. They cite "significant unmet need" for the company's products among growing global markets.

I also like that the ASX 200 biotech stock invests around 10% of its sales revenue into research and development. That includes exploring the growing powers of generative AI to enhance its global operations.

The CSL share price is down 1% over the past 12 months, having taken a big hit in June when sharper-than-expected foreign currency headwinds saw the company reduce its profit forecast.

The ASX blue-chip stock has enjoyed a strong rebound in recent months, however, with shares up 30% since 30 October.

CSL trades on a partly franked dividend yield of 1.2%