Bank of Queensland Ltd (ASX: BOQ) shares are currently up by 0.3% today following the company's news that it's selling its New Zealand portfolio of assets, leading to the exit from one of its markets. However, the rise is less than the rise of the S&P/ASX 200 Index (ASX: XJO) which is up around 0.9%.

New Zealand asset sale

BOQ revealed it's selling its New Zealand portfolio of assets to UDC Finance.

The ASX bank share explained this move is part of its strategic simplification program, streamlining the bank's operating model and simplifying its compliance requirements by exiting a "small, non-core lending portfolio in an overseas jurisdiction."

The sale of the portfolio has been agreed at 91% of book value, subject to completion date adjustments. At 31 January 2024, the portfolio size was NZ$238 million, which translated into approximately A$221 million. A quick calculation would suggest the sale price would have been just over A$200 million if the sale had been done on 31 January 2024.

In terms of what it's actually selling, it consists of commercial loans as well as finance and operating leases originated and serviced by BOQ Finance (NZ) Limited and BOQ Equipment Finance Limited.

Financial impact

Bank of Queensland shared what it expects the impact will be on its financials.

This transaction is estimated to see a post-tax statutory loss on sale of approximately A$17 million to A$20 million, which will be recognised in the FY24 first half.

After the deal is completed, BOQ thinks it will be "broadly neutral" to its common equity tier 1 (CET1) capital ratio.

The portfolio represents "less than 0.5%" of BOQ's overall net loans and advances as at FY23 and it made an "immaterial contribution" to BOQ's net profit in the same period.

Management comments

The BOQ managing director and CEO Patrick Allaway said:

This transaction is another step in our strategic simplification program, exiting a non-core business and reducing our operational complexity.

Chris Screen, the BOQ executive for business banking, was happy with the buyer for the NZ assets, he said:

We are pleased to have secured a buyer in UDC, the largest non-bank lender and a leading asset finance business in New Zealand, that will continue to serve and provide a high level of support for these customers and employees.

Bank of Queensland share price snapshot

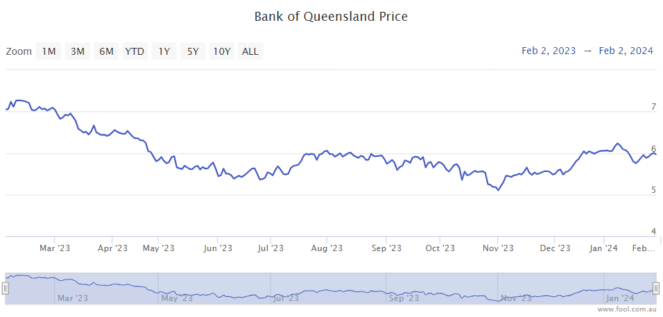

Over the past year, BOQ shares have fallen 15%.