S&P/ASX 300 Index (ASX: XKO) stock Select Harvests Ltd (ASX: SHV) has jumped 16% after the company released an exciting 2024 update.

The Australian almond grower is benefiting from an improving situation for pricing and a healthy crop update.

Favourable conditions for 2024 crop

Select Harvests revealed that the 2024 crop is in the final stages of the growing cycle and the harvest is expected to start next week, which is two weeks earlier than normal. It's finalising pre-harvest preparations across all sites.

The ASX 300 stock said the current weather forecast for the harvest period is "favourable" and the crop is forecast to exceed 30,000MT and return to a "quality profile" in line with long-term averages.

Pleasingly, the company said its initiatives are continuing to reduce production costs, while the recent cooler and wetter weather has led to lower requirements for water, irrigation electricity demand and a decline in water pricing.

It expects "further value" to be created as it continues to work on and deliver its current projects and identify additional opportunities.

Improving market conditions

Select Harvests said global almond market conditions are "increasingly positive".

The ASX 300 stock pointed to key US industry participants, such as growers, marketers and processors, who are forecasting that the US 2023 crop will be approximately 6% to 12% lower than the USDA 2023 objective estimate.

On top of that, the US 2023 crop is forecast to be of lower quality with increased instances of navel orange worm damage and sub-optimal sizing, with a doubling of the normal defect rate being reported by the Almond Board of California.

December 2023 saw the fourth consecutive month of US shipments growth, according to the Almond Board of California Position Report. The 2023-2024 year-to-date US shipments are up 9.9%, with "improvements in export markets and the US domestic market remaining steady".

Unsurprisingly, the US inventory levels have decreased year over year and are currently at 1.8 billion pounds, 13.4% lower than December 2022. The forecast 2024 carryout inventory has reduced to 0.6 billion – that's 21.9% lower than the 2023 carryout position.

Pricing for Select Harvests' almonds

Select Harvests said its 2023 export program is complete. All remaining inventory is planned to maintain value-add production and domestic customer contracts.

Market prices for almonds are "rising", particularly for higher grade material, and export markets are becoming "increasingly active. Based on a normal crop profile Select Harvests' net sell price is currently above A$7.50 per kg and "may increase further based on market demand."

Marketing of its 2024 crop began in January, with approximately 10% pre-sold at "attractive pricing levels." More than 60% of the 2024 crop is hedged at an Australian dollar to US dollar exchange rate of 0.66.

The other financial aspect of the ASX 300 stock's update revealed that its debt position remains "on track" and that the company remains within its facility headroom and covenants are forecast to be met.

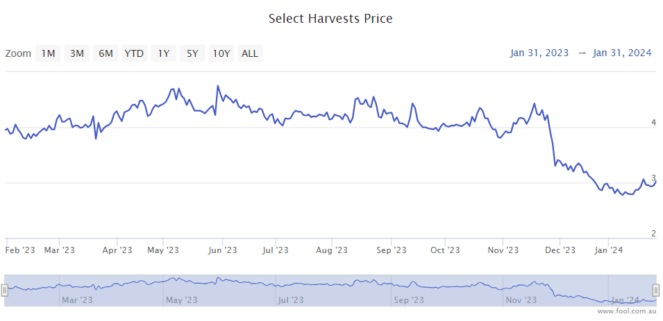

Select Harvest share price snapshot

Despite today's strong rise, the company is still down more than 8% in the past year.