S&P/ASX 200 Index (ASX: XJO) gold stock Gold Road Resources Ltd (ASX: GOR) is under heavy selling pressure today.

Shares in the Aussie gold miner closed Friday trading for $1.71. During the Monday lunch hour, shares are swapping hands for $1.47 apiece, down 14.3%.

For some context, the ASX 200 is up 0.1% at this same time. While the S&P/ASX All Ordinaries Gold Index (ASX: XGD) – which also contains some smaller miners outside of ASX 200 gold stocks – is down 1.8%.

Here's what's happening.

(Note, all figures in Aussie dollars.)

ASX 200 gold stock slides on falling production

The Gold Road share price is taking a beating today following the release of the company's quarterly update covering the three months ending 31 December.

The ASX 200 gold stock is in a 50:50 joint venture with Gruyere Mining Company at the Gruyere Gold Mine, located in Western Australia.

Investors are hitting the sell button after Gold Road reported that Gruyere produced 74,659 ounces of gold (100% basis) at an all-in sustaining cost (AISC) of $1,973 per ounce.

That's down from 88,668 ounces produced in the September quarter. And costs were also up from the prior quarter's AISC of $1,682 per ounce.

Management attributed the slide in production to delays accessing higher grade ore from the open pit. They said that labour availability also impacted the ore mining rate.

2023 annual production from Gruyere came in at 321,984 ounces. That met the ASX 200 gold stock's guidance, though barely, with the miner having forecast full year production in the range of 320,000 to 350,000 ounces.

And 2023 costs came in just above the higher end of guidance of $1,540 to $1,660 per ounce, with Gold Road reporting an AISC of $1,662 per ounce for the 12 months.

The miner reported gold sales of 37,037 ounces at an average sales price of $3,040 per ounce. The company remains unhedged, and is 100% exposed to the spot gold price.

Free cash flow also dropped significantly quarter on quarter to $13.8 million, down from $51.7 million in the September quarter.

Looking ahead, management said 2024 annual production is guided at between 300,000 and 335,000 ounces, of which 150,000 to 167,500 ounces is attributable to Gold Road. They forecast an attributable AISC of between $1,900 and $2,050 per ounce.

Gold Road share price snapshot

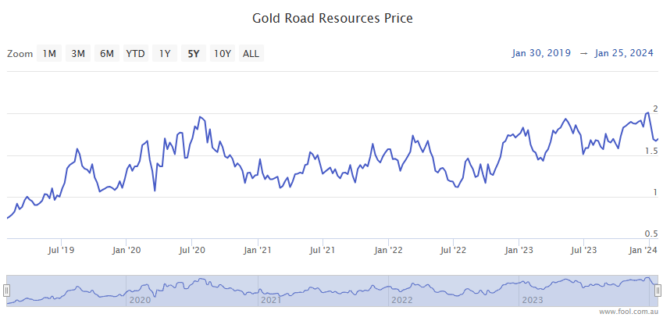

After a strong run in 2023, things have turned the other way for Gold Road shareholders so far in 2024.

Since the closing bell on 29 December, shares in the ASX 200 gold stock are down 26%.