A Western Australian man has pleaded guilty to insider trading after being caught making $770,000 in a single day with his ASX shares.

At Stirling Gardens Magistrates Court on Thursday, Cameron Waugh pleaded guilty to one count of applying for shares while in possession of inside information.

He now faces a potential 15 years' imprisonment, as that was the maximum penalty at the time of the offence in 2021.

Bought ASX shares while he had information not available to the public

The court heard that Waugh was a corporate advisor at Omnia in 2021 when he came across a funding proposal for placement of shares for Genesis Minerals Ltd (ASX: GMD).

He was also privy to a plan that would see Raleigh Finlayson and Neville Power joining the gold miner's board through a restructure.

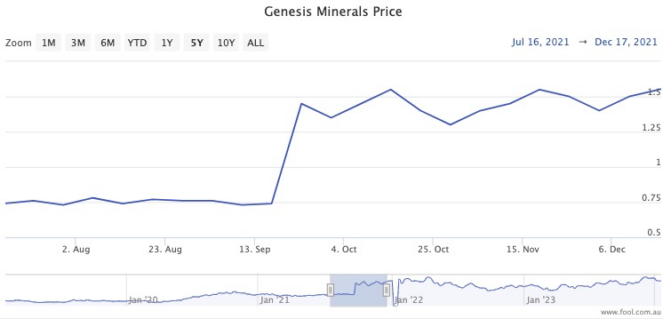

In the period between 14 to 21 September, while all that information was not yet publicly known, Waugh bought up 747,626 shares in Genesis Minerals.

The stock price during that time varied between 71 and 74 cents. Assuming the highest price, he would have spent $553,243.

On 22 September, the miner made an announcement to the ASX that revealed the stock placement and the board restructure.

That day Genesis shares rocketed 187%, to close at $1.77.

Waugh's holding was instantly worth $1.32 million.

After the guilty plea, the case has been transferred to the Supreme Court of Western Australia, where sentencing will take place on 26 March.

Genesis shares on Wednesday afternoon were trading at $1.60.

According to CMC Markets, four out of six analysts currently rate the gold miner as a strong buy.