The Core Lithium Ltd (ASX: CXO) share price is enjoying a big lift today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for 19.5 cents. At the time of writing on Wednesday morning, shares are changing hands for 20.5 cents apiece, up 5.2%.

For some context, the ASX 200 is up a slender 0.1% at this same time, with most lithium producers also outperforming.

Here's what's happening.

Core Lithium share price lifts on production boost

The Core Lithium share price looks to be getting a boost following the release of the company's quarterly update for the three months ending 31 December.

Among the biggest news, was management's decision to temporarily suspend operations of its open pit mining operations at Finniss as part of the company's Q2 Strategic Review. The Core Lithium share price closed down 11.5% on 5 January, the day of that announcement.

"With the rapid shifts in lithium market pricing, Core moved quickly to undertake a strategic review, resulting in the temporary suspension of mining and BP33 early works to conserve cash, and preserve the value of the underlying business," CEO Gareth Manderson said.

Atop conserving cash, Core reported a 39% quarter on quarter increase in spodumene concentrate production to 28,837 tonnes.

Lithia recoveries for the three months averaged 60%, up 20% from the prior quarter.

And the 30,718 tonnes of spodumene concentrate shipped was up 31% from last quarter.

The miner also prepared for the wet season, with 289,000 tonnes of ore stocks at the end of the quarter, up 56% from Q1.

With mining temporarily halted, Core reduced its capital spend guidance and cash operating cost guidance.

Commenting on the quarterly performance that looks to be offering a lift for the Core Lithium share price, Manderson said, "There is no doubt we have seen strong operational improvement at Finniss as it has ramped up throughout the year."

Manderson added:

The work undertaken ahead of the wet season has successfully established ore stockpiles that will see us produce concentrate for the next 5-6 months at a lower overall cash cost, due to the suspension of mining.

This approach will preserve Finniss' long-term value and ensure we are prepared to move quickly to restart mining in a more favourable pricing environment.

As at 31 December, Core has a cash balance of $125 million.

How has the ASX 200 lithium miner been performing?

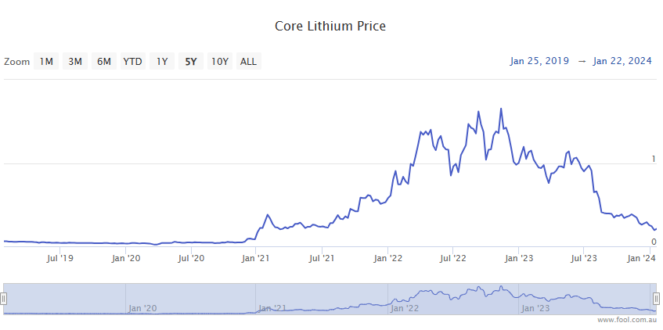

It's been a rough year for the Core Lithium share price amid a crashing lithium price and the suspension of the company's mining operations.

Despite today's welcome lift, shares in the ASX 200 miner remain down 81% over the past 12 months.