Investors must be careful that they don't "buy the dip" on S&P/ASX 200 Index (ASX: XJO) shares just because they're cheap.

After all, they might have dived simply because they're terrible businesses. There is absolutely no guarantee that any fallen stock will again rise to its former heights.

However, if the company is performing well and the external conditions seem favourable, then you're in with a fighting chance to buy the dip on a true bargain.

Here are two ASX 200 stocks precisely in that spot, which experts are rating as buys:

The stock to 'move higher in the next six months'

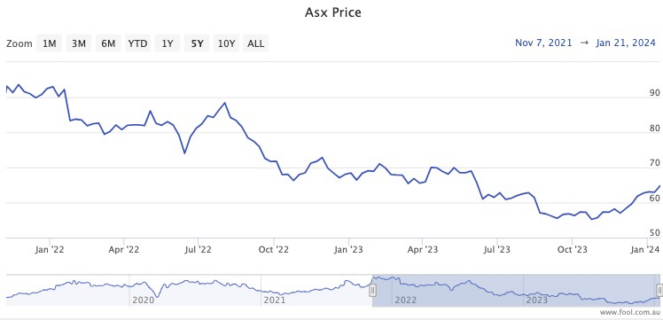

The actual company that runs the ASX, ASX Ltd (ASX: ASX), has seen its share price tumble for a long time now.

The shares are 30.8% lower than where they were in November 2021, as troubles over its technology upgrade projects have frightened investors.

That's despite a respectable fully franked dividend yield of 3.5%.

Marcus Today analyst Oliver Matthew is predicting a turnaround for ASX Ltd.

"We expect the share price of Australia's biggest securities exchange to move higher in the next six months as global interest rates peak, bond yields fall and equities rise," Matthew told The Bull.

The simple fact is that business is booming.

"The average daily number of trades in cash markets in December 2023 was up 13% on the prior corresponding period. Cash markets include equities, interest rate and warrant trades," said Matthew

"The average daily value traded on-market was $5.371 billion, up 2% on the prior corresponding period."

He added that a revival might already be underway, with the stock price now more than 19% higher than it was in October.

Buy the dip on this energy stock

Russia's invasion of Ukraine a couple of years ago showed the world that there is still much work to do before renewable sources can take over the energy market.

This is why, sadly, Fairmont Equities managing director Michael Gable reckons there's still legs in fossil fuel investments.

"We continue to retain a bright outlook for crude oil. Supply constraints and increasing global demand should elevate energy prices."

And there is one particular energy stock that his team is recommending as a buy right now.

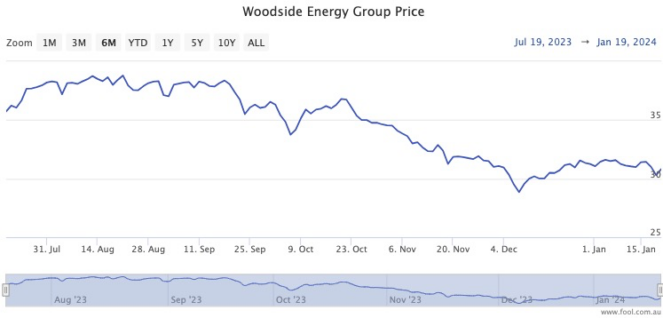

"Woodside Energy Group Ltd (ASX: WDS) shares are attractive at these levels."

The stock is in a particularly tempting dip at the moment, trading 19.5% cheaper compared to its September peak.

A sweet fully franked dividend yield of 11% helps too.

According to CMC Invest, seven out of 13 analysts currently rate Woodside as a buy.