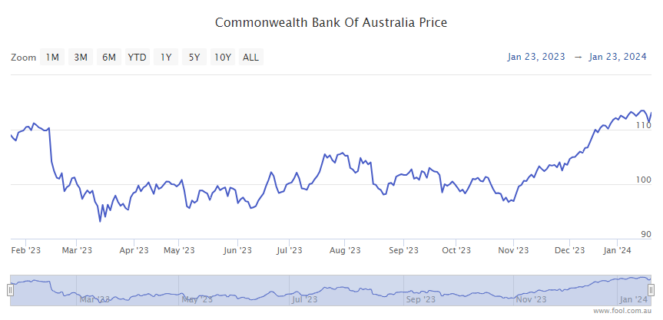

Commonwealth Bank of Australia (ASX: CBA) shares hit a new 52-week high of $115.98 in early trading on Tuesday.

The CBA share price is currently up 0.72% to $115.69, while the S&P/ASX 200 Index (ASX: XJO) is up 0.7%.

CBA shares have been rising strongly since early November, as the chart below shows.

The 52-week high comes amid Australia's biggest home loan lender releasing its 2024 economic outlook.

The outlook includes CBA's forecasts for the property market over the new year.

CBA shares hit new 52-week high

Senior CBA economist, Belinda Allen said the Australian housing market is likely to moderate in the first half of the year before rebounding in the second half following interest rate cuts.

CBA's economics team predicts the Reserve Bank will start cutting interest rates in September and will reduce the official cash rate by 75 basis points by Christmas.

Strong demand, driven by an anticipated 2.3% in final population growth for 2023, coupled with an ongoing housing shortage, pushed property prices higher in 2023 despite rising interest rates.

This tight supply/demand dynamic will remain in 2024, with population growth of 1.8% anticipated this year amid only a small lift in the number of new home commencements, Allen said.

Many of the same factors that drove prices higher are set to be in place in 2024, albeit with less intensity.

However we expect affordability constraints and rising advertised supply to put a handbrake on home price growth over the first half or so of 2024.

Overall we expect a lift of 5% in home prices across the 8 capital cities this year.

Property price predictions for 2024

Here are CBA's forecasts for home values growth over 2024.

| Capital city | Growth prediction |

| Perth | 9% |

| Adelaide | 9% |

| Brisbane | 8% |

| Sydney | 3% |

| Melbourne | 2% |

In 2023, Perth and Adelaide led the capital cities in terms of price growth at 15.2% and 13.1%, respectively, according to CoreLogic data. (View our article ASX 200 shares vs. property: Which delivered the best growth in 2023?)

While the CBA team expects prices to grow overall in 2024, there would be a "considerable divergence" in market activity between the capital cities over the new year.

Allen explained:

We expect a distinct period of moderation, including small monthly falls in Sydney and Melbourne over the first half or so of 2024.

We also expect the other major capital cities of Brisbane, Perth and Adelaide to experience slower monthly growth than in 2023.

Interest rate cuts beginning in September are then expected to spur a period of faster monthly home price growth to finish the calendar year.

Allen said affordability would be a factor slowing down market activity in Sydney and Melbourne.

High rents push young people into ownership

Ms Allen noted that Australia's extremely tight rental market is propelling more people into home ownership.

She said:

Rents rose by just under 10%/ yr to November and we don't expect a material change in the near term. Vacancy rates sit at, or close to record lows.

Lending for housing rose in the back half of 2023.

Lending to first home buyers led the charge, with annual growth sitting at 25.8%/yr to November 2023. Total lending excluding refinancing has been rising since August.

CoreLogic data released today shows the median weekly rent in Australia has surpassed $600 per week for the first time.

Head of research at CoreLogic, Eliza Owen, said rapid population growth, reduced household sizes, lower investor buying, and a spike in landlords selling had reduced rental stock and pushed up weekly rents.

How do rising home values impact CBA shares?

CBA is Australia's biggest home mortgage lender, so a strong property market is a tailwind for its shares.

According to CBA's FY23 report, the bank had $577 billion in home loans on its books as of 30 June FY23.

That's up from $562 billion as of 31 December 2022 and $546 billion as of 30 June 2022.

Just over 70% of CBA's home loans are on a variable rate. This is up from 66% in December 2022 and 62% in June 2022.

Borrowers experiencing negative equity increased to 1% as of 30 June 2023. This is a rise from 0.5% in December 2022 and 0.4% in June 2022.

Mortgagee-in-possession loans held at 2% of CBA's home lending portfolio over this 12-month period.